Education

While most investors obsess over market predictions and year-end rallies, sophisticated investors focus on three concrete actions that actually move the needle: maximizing contributions, strategic rebalancing, and knowing what noise to ignore. Here's the checklist that separates discipline from distraction.

Maxing Out Contributions: The December 31 Deadline

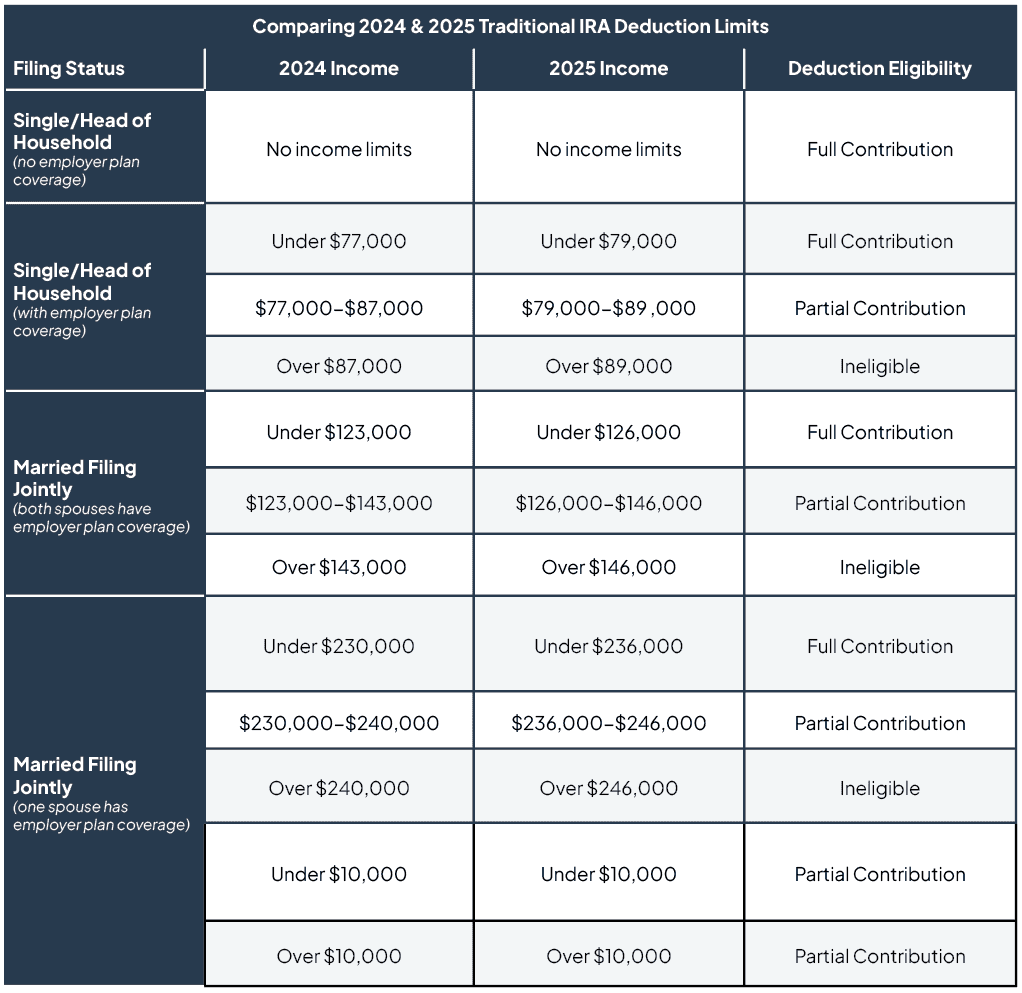

401(k) contributions must be completed by December 31, unlike IRAs which offer until Tax Day. For 2024, the 401(k) employee contribution limit is $23,000, with an additional $7,500 catch-up contribution for those 50 and older.

The 2025 limits remain largely unchanged at $23,500, but include a significant new provision: employees aged 60-63 can now contribute an additional $11,250 in catch-up contributions—substantially higher than the standard $7,500 catch-up.

Key contribution facts:

401(k)/403(b)/TSP deadline: December 31 of the tax year

IRA contribution deadline: April 15 of the following year

HSA contributions: Can be made until April 15

Why this matters: Every dollar contributed reduces your current taxable income while growing tax-deferred. Missing the December 31 deadline for workplace plans means permanently losing that year's contribution space—you cannot make it up later.

According to Vanguard's research, waiting until the tax deadline to contribute means missing more than 15 months of potential compounding. A $7,000 IRA contribution made in January 2025 versus April 2026 creates meaningfully different long-term outcomes.

Tax-Loss Harvesting: Strategy, Not Desperation

Tax-loss harvesting involves selling investments at a loss to offset capital gains and potentially reduce up to $3,000 in ordinary income. But execution matters more than intent.

The mechanics:

Realized losses offset realized gains dollar-for-dollar

Short-term losses offset short-term gains first

Excess losses offset up to $3,000 of ordinary income annually

Remaining losses carry forward indefinitely

Russell Investments' 2024 study found portfolio rebalancing combined with tax-loss harvesting can reduce portfolio volatility by 1.2% over time. Wealthfront reported that their tax-loss harvesting generated an average annual harvesting yield of 4.23% over the past decade for clients.

Critical wash-sale rule: You cannot repurchase the same security or a "substantially identical" one within 30 days before or after the sale. Violating this rule disallows the loss entirely. The IRS doesn't provide precise guidance on "substantially identical," but buying the exact same stock or a single-stock ETF tracking it clearly violates the rule.

Smart execution strategies:

Sell losing positions and immediately buy similar but not identical securities (S&P 500 ETF → total market ETF)

Use the proceeds to rebalance toward your target allocation

Specify which tax lots you're selling to maximize or minimize gains/losses

Coordinate with your year-end bonus or other income spikes

According to advisors surveyed in December 2024, the biggest mistake investors make is not accounting for lot identification rules—the IRS assumes first-in-first-out (FIFO) unless you specify otherwise at the time of sale.

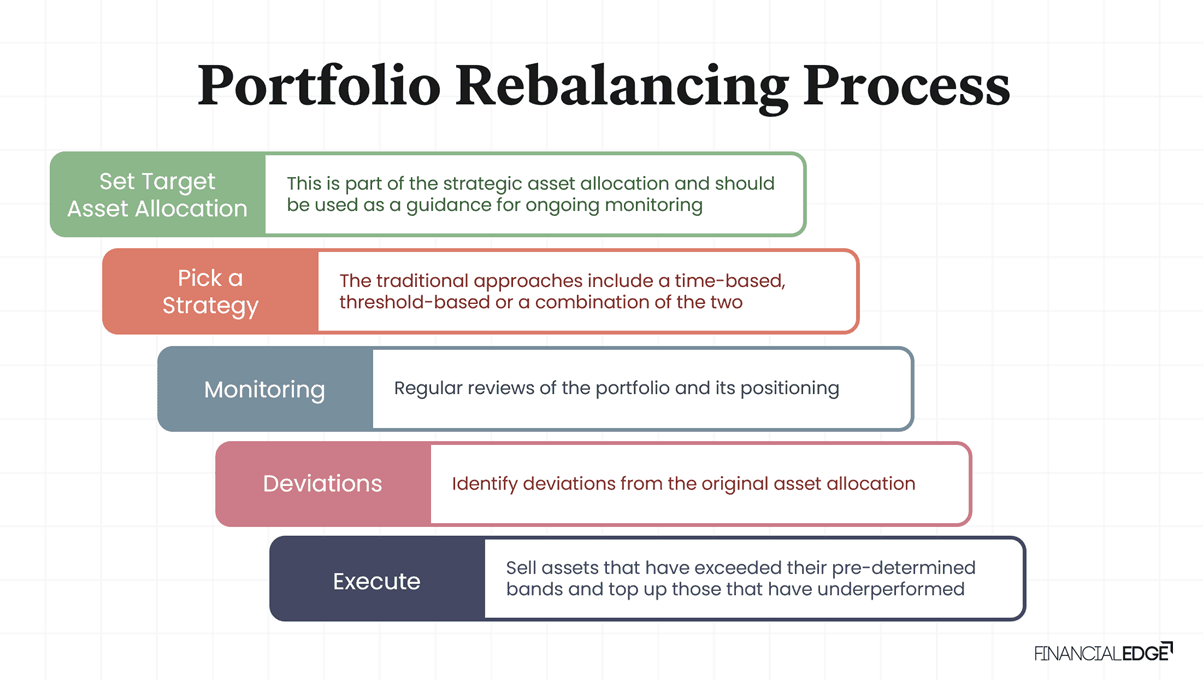

Portfolio Rebalancing: Discipline Over Timing

Markets don't cooperate with calendar-based strategies, but year-end provides a natural checkpoint to restore your target allocation.

When to rebalance:

Your portfolio has drifted 5+ percentage points from target allocation

Annual review reveals significant sector concentration

Life changes warrant allocation adjustments

Tax-loss harvesting creates rebalancing opportunities

Rebalancing methods:

Threshold-based: Rebalance when allocations drift beyond set bands

Calendar-based: Rebalance quarterly, semi-annually, or annually

Hybrid: Review quarterly, rebalance only when thresholds breach

Vanguard's research shows tax-efficient rebalancing should prioritize tax-deferred accounts first. Rebalancing in taxable accounts triggers capital gains, while rebalancing within IRAs and 401(k)s creates no immediate tax impact.

Strategic pairing: Combine rebalancing with tax-loss harvesting. If you need to sell winning tech stocks to rebalance, simultaneously sell losing positions in other sectors to offset the gains. This "surgical approach to wealth management" preserves your allocation while minimizing tax impact.

What rebalancing reveals:

Whether you're taking more risk than intended

Concentrated positions requiring diversification

Opportunities to shift toward better-performing asset classes

Cash drag from excess emergency fund holdings

What Smart Investors Ignore

The discipline to ignore noise matters as much as taking action. Here's what not to do:

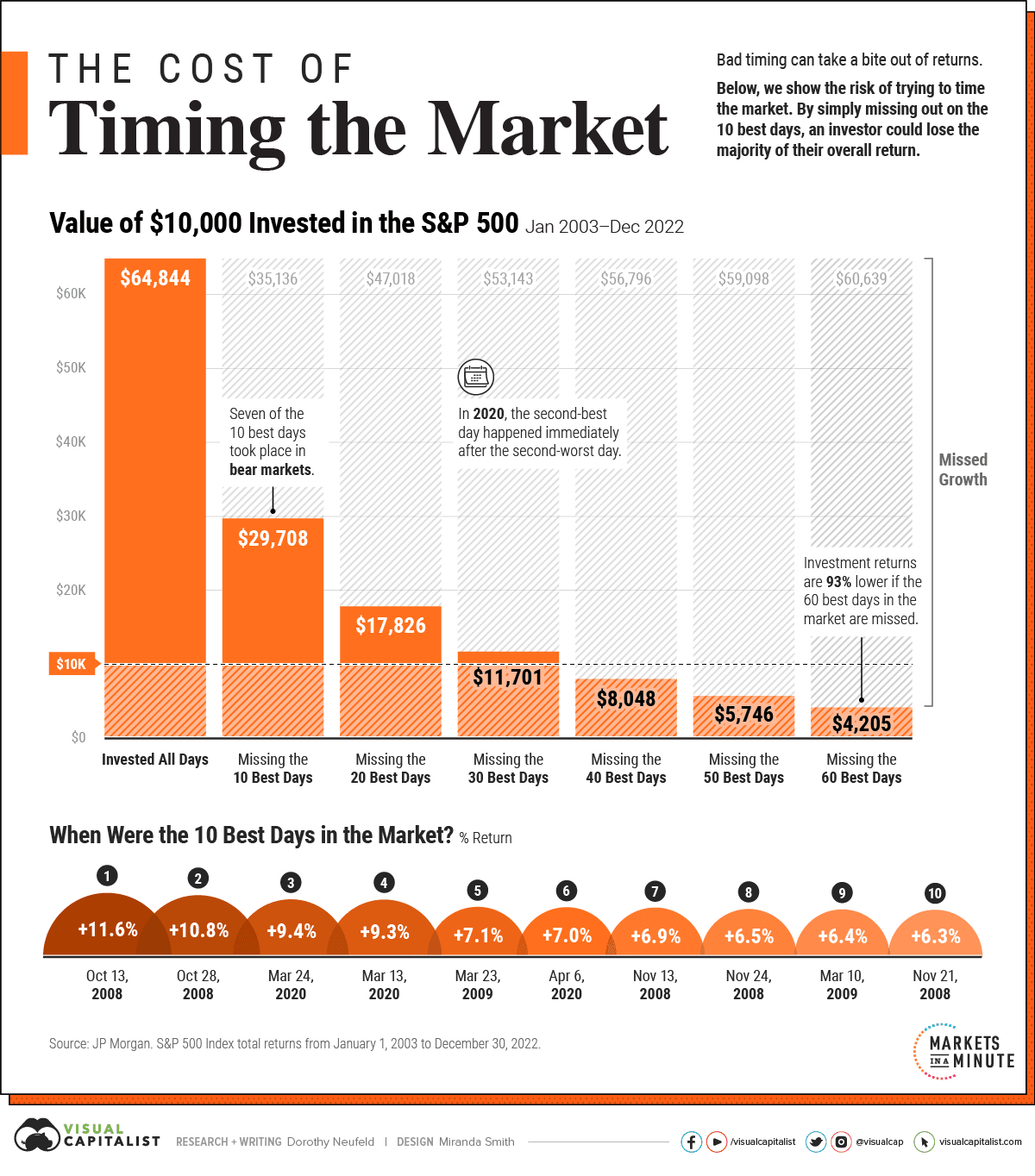

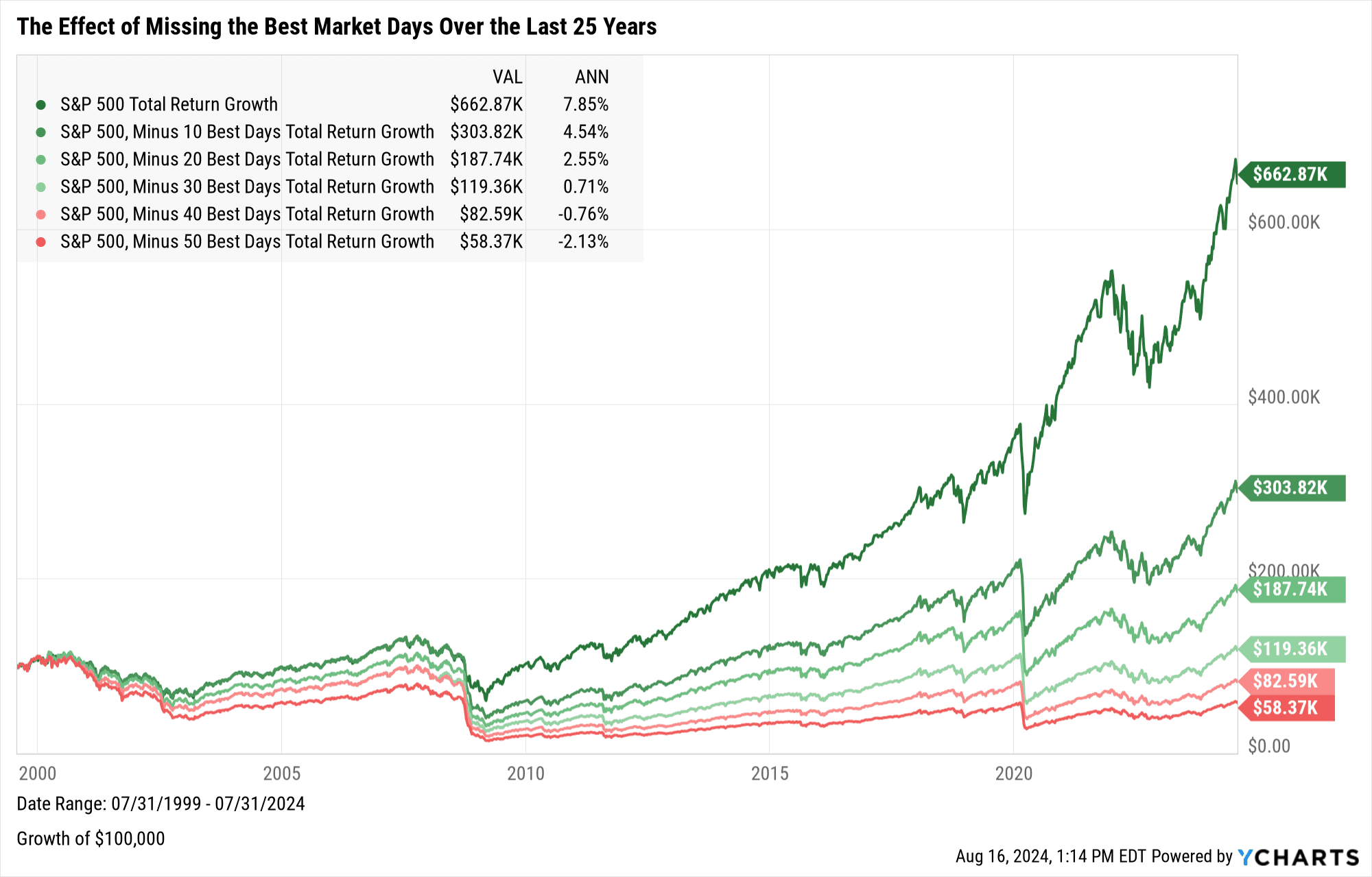

Ignore short-term market predictions: 78% of the stock market's best days occur during bear markets or the first two months of bull markets. Missing just the 10 best days over 30 years would have cut returns in half.

Schwab's research examining 20 years ending in 2024 found that even perfect market timing—investing $2,000 annually at each year's absolute low—generated only 9% more wealth than simply investing on January 1 each year. The investor who waited for perfect timing but held cash generated 63% less wealth than the consistent investor.

Ignore seasonal patterns as actionable signals: The January Effect, Santa Claus Rally, and similar calendar-based patterns have lost statistical significance in recent decades. Goldman Sachs declared the January Effect dead in 2017, and 2024's reverse Santa Claus Rally—the first in the S&P 500's history—proved that decades-old patterns offer no predictive power.

Ignore the urge to sell during volatility: Since 1980, the stock market delivered positive annual returns 75% of the time despite average intra-year declines exceeding 14%. The 2024 August selloff—when the VIX spiked to 65.73—recovered entirely within weeks, whipsawing investors who sold.

Ignore cash as a long-term strategy: While 5% Treasury yields sound attractive, inflation-adjusted returns on cash average around 2%—dramatically underperforming the S&P 500's 26% return in 2024. JP Morgan's analysis found that cash generated essentially zero inflation-adjusted return over 30 years.

Ignore emotion-driven portfolio changes: Morningstar's 2024 research found investors who make frequent changes based on market sentiment consistently underperform those who maintain disciplined strategies. Short-term market fluctuations are normal—reacting to them is costly.

The December 31 Action List

Here's what actually needs completion before midnight on New Year's Eve:

Must do by December 31:

Finalize 401(k)/403(b)/TSP contributions

Execute tax-loss harvesting trades (settlement date matters—plan for T+1)

Complete Roth conversions

Take required minimum distributions (RMDs) if applicable

Make final quarterly estimated tax payments

Complete 529 plan contributions for current year

Can wait until April 15:

IRA contributions (traditional and Roth)

HSA contributions

SEP-IRA contributions

Solo 401(k) employee deferrals (employer contributions have different deadlines)

Should do but no hard deadline:

Review beneficiary designations

Update estate planning documents

Verify rollover completions from old 401(k)s

Document your target allocation for next year

Set calendar reminders for quarterly rebalancing checks

Building Systems That Last Beyond December

The most valuable year-end activity isn't maximizing this year's tax strategies—it's building systems that reduce future decision-making.

Automation eliminates emotion:

Auto-increase 401(k) contributions by 1% annually

Schedule automatic monthly IRA contributions

Set rebalancing alerts when allocations drift 5%

Dollar-cost average into markets regardless of headlines

Documentation creates accountability:

Write down your target allocation and why

Record your investment thesis for each holding

Document the conditions that would warrant selling

Track which strategies actually added value

The investors who outperform don't have better market predictions—they have better systems. They maximize contributions automatically, rebalance systematically, harvest losses strategically, and ignore noise completely.

Year-end isn't about perfecting this year's taxes or timing January's market moves. It's about building the discipline that compounds across decades. The checklist above works because it focuses on controllable actions with measurable impact, not market predictions or seasonal patterns.

For investors seeking platforms that operationalize this discipline, tools like Surmount automate systematic rebalancing and portfolio management, removing the emotional decision-making that undermines long-term performance. Technology can't predict markets, but it can enforce the discipline that markets reward.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.