Education

You believe you're a rational investor who can handle market volatility. You've filled out the risk questionnaire, scored yourself as "moderately aggressive," and allocated accordingly. Then March 2020 hits. Or August 2024. Or any Tuesday when headlines scream and your portfolio bleeds red.

Suddenly, that confident risk tolerance evaporates. You sell. You panic. You lock in losses at precisely the wrong moment.

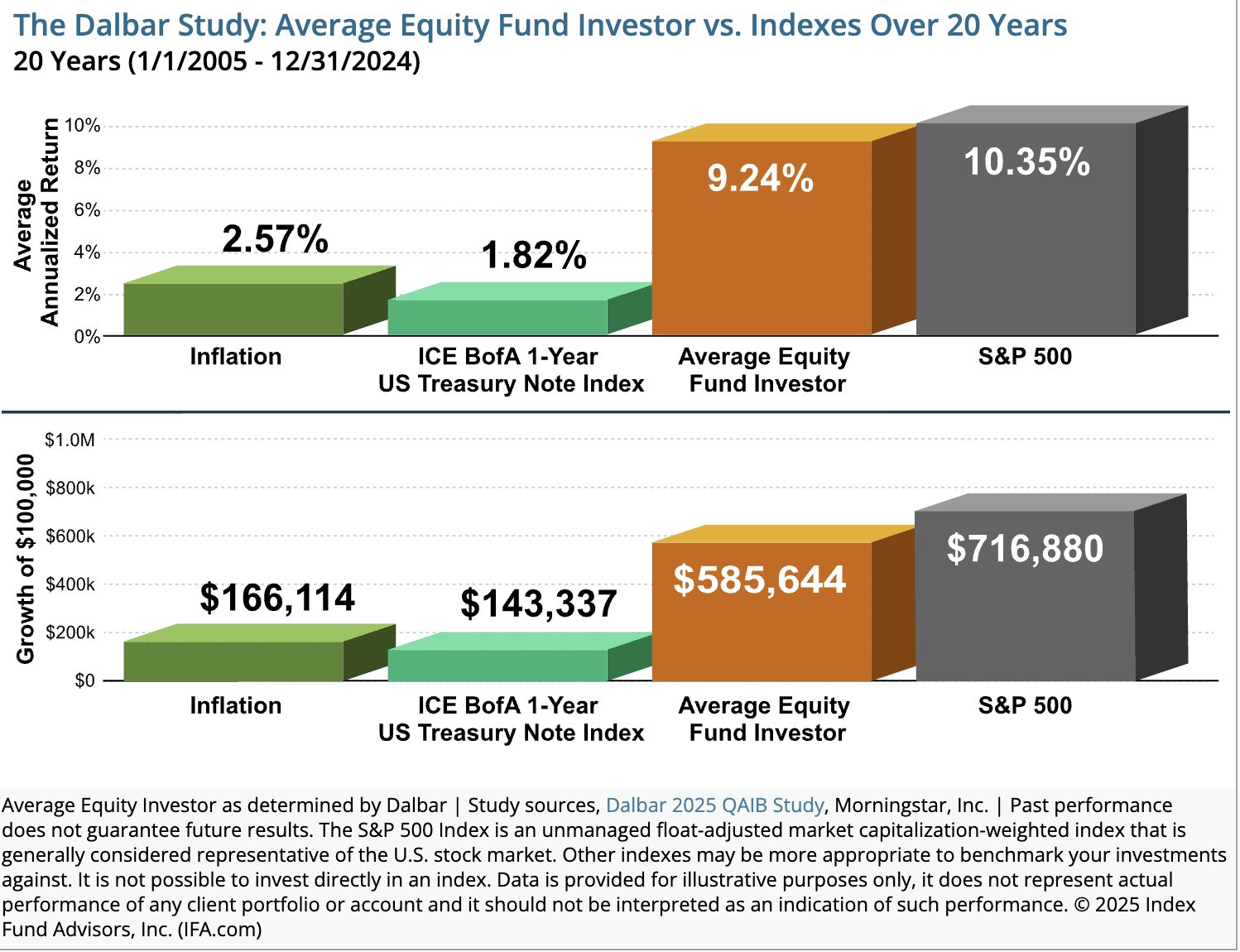

In 2024, the average equity investor earned just 16.54% while the S&P 500 returned 25.02%—an 848-basis-point gap that marked the second-largest underperformance of the past decade. It was about behavior, not market performance.

The uncomfortable truth? Most of us fundamentally misunderstand our own risk tolerance. We:

Overestimate our ability to stay calm during volatility

Underestimate the psychological weight of losses

Confuse theoretical comfort with real-world resilience

The result is a chronic behavior gap that erodes returns year after year—not because markets fail us, but because we fail ourselves.

The Questionnaire Illusion

Walk into any financial advisor's office and you'll encounter the risk tolerance questionnaire—a staple of modern portfolio construction:

Answer 13 questions about hypothetical scenarios

Receive a score

Get matched to a model portfolio

Simple, scientific, regulatory-compliant. And fundamentally flawed.

Studies show a fundamental disconnect between stated and actual risk tolerance, with investors often saying one thing about risk but behaving entirely differently when making real decisions.

Recent research from the FINRA Investor Education Foundation found that while eight in ten consumers have at least a basic understanding of investment risk, only 55% can recognize risk-mitigation strategies. Understanding risk conceptually differs vastly from managing it emotionally when your retirement account drops 20% in a month.

The Timing Problem

These questionnaires face a critical timing problem: risk tolerance questions asked following periods of low stock returns tend to elicit answers that underestimate investors' true tolerance, while bull market responses tend to inflate it.

You're not measuring a stable trait—you're capturing a mood influenced by recent experience.

The Overconfidence Trap

Research on investor psychology reveals that overconfidence leads investors to overestimate their analytical abilities and financial knowledge while self-assuring high returns. This manifests in two particularly damaging ways.

Knowledge ≠ Emotional Resilience

You might thoroughly understand that:

Markets historically recover

Volatility is normal

Long-term investors win

None of this intellectual understanding prepares you for the visceral panic of watching your portfolio crater.

A large-scale study of 161,765 Japanese investors found that overconfidence in financial literacy significantly undermined investment loss tolerance beyond baseline levels. The more confident people felt about their financial knowledge, the less capable they were of weathering actual losses—a paradox that devastates returns.

The Competitive Mindset

Investors with this mindset may be more competitive and market-focused than they admit, leading them to take on more risk than intended to achieve market-beating gains. They frame their risk tolerance around upside potential while systematically underweighting downside reality.

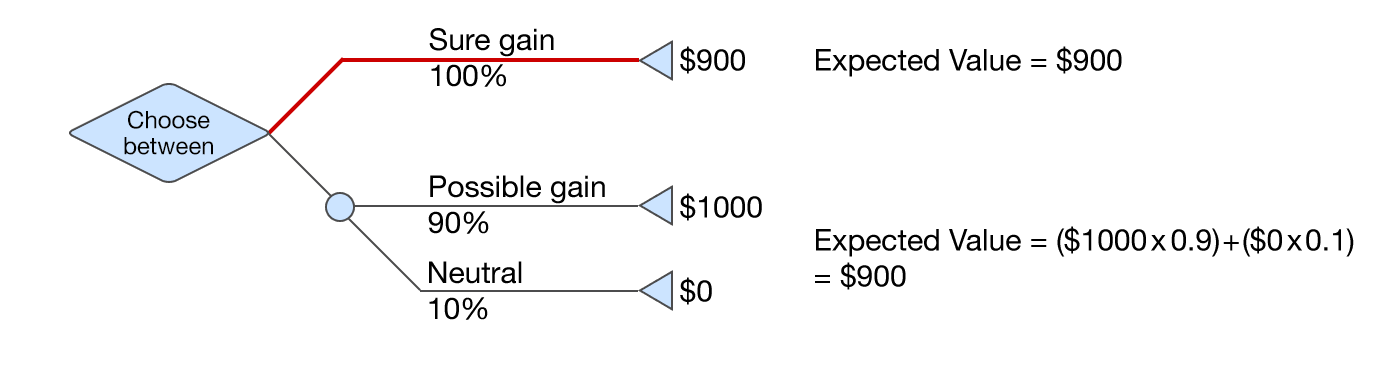

Loss Aversion: The 2.5x Problem

Here's where psychology delivers its cruelest blow. Research by Amos Tversky and Daniel Kahneman found the loss aversion coefficient for humans falls between 1.5 and 2.5, meaning losses weight up to 2.5 times more than equivalent gains.

Practically, this means:

The $10,000 your portfolio loses needs a $25,000 gain to restore your emotional equilibrium

This asymmetry warps investment behavior in predictable ways:

Faced with losses: Investors become paradoxically risk-seeking—doubling down, averaging down, gambling for recovery

Faced with gains: They become risk-averse—booking profits too early, leaving massive returns on the table

During the August 2024 volatility spike, the VIX jumped above 65—marking only the third time since 1990 it exceeded 60 outside the 2008 financial crisis and COVID-19 pandemic. Many investors who panicked and sold missed the rapid recovery, with the Japanese market regaining all lost ground within a week.

The Behavior Gap: Decades of Evidence

The evidence of this chronic overestimation spans decades. According to DALBAR's Quantitative Analysis of Investor Behavior, average equity investors have now underperformed the S&P 500 for 15 consecutive years, with 2009 being the last time they beat the index.

The Pattern Repeats

Over the 30-year period ending December 31, 2023, the average annual return for investors was significantly lower than market indices—largely due to poorly-timed buy and sell decisions driven by emotional reactions to volatility.

The pattern repeats with mathematical precision:

In 2024, withdrawals from equity funds occurred every quarter

The largest outflows came in Q3—just before a major rally

Investors consistently exit at bottoms and enter at tops

A study of 121,293 active investors during the COVID-19 crisis found that hyperbolic discounting and fear of immediate loss triggered widespread panic selling, with investors divesting from stocks without fully considering potential consequences.

What Market Timing Costs You

Let's quantify the damage. Someone who stayed invested from 1980 through February 2025 would have earned a 12% annual return, whereas someone who sold after downturns and waited for two consecutive positive years before re-entering would have averaged 10% annually.

The $2.5 Million Mistake:

With $5,000 annual contributions over 45 years:

Buy-and-hold investor: $6.1 million

Market timer: $3.6 million

Difference: $2.5 million

That difference represents the true cost of overestimating your risk tolerance and acting on that overestimation.

Beyond the Questionnaire: A Better Approach

The solution isn't to abandon risk assessment—it's to approach it with ruthless honesty and behavioral safeguards.

1. Stress Test Your Emotions, Not Just Your Portfolio

Don't ask yourself how you'd feel about a 20% decline. Walk through specific scenarios showing how portfolios might perform under various conditions to gain a more realistic view of your actual tolerance.

Ask yourself: When your account statement shows $80,000 instead of $100,000, what's your instinct?

To rebalance and buy more?

Or to sell and "protect what's left?"

Your answer in October 2024 might differ from January 2025. That variability is the point.

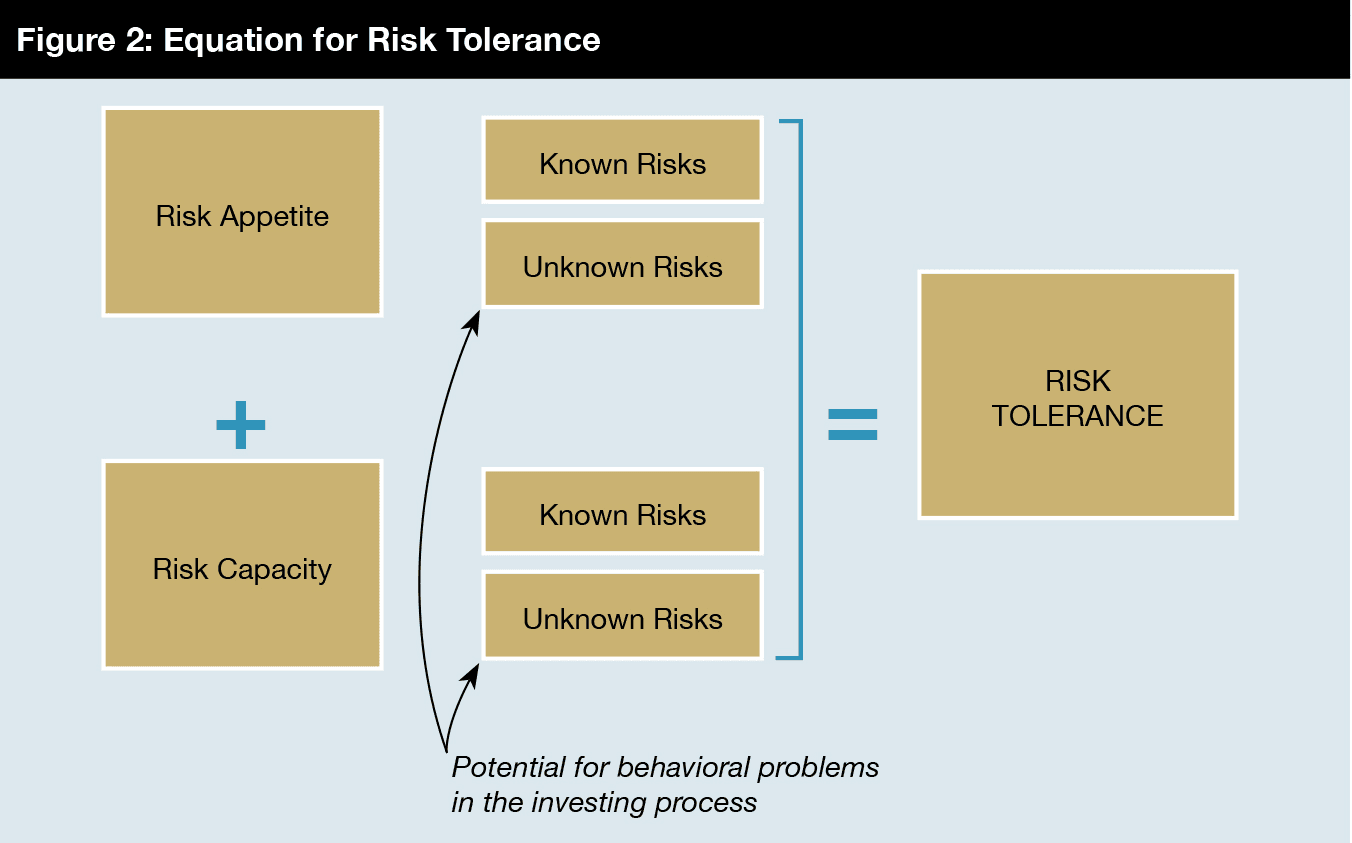

2. Separate Risk Tolerance from Risk Capacity

Risk tolerance measures psychological comfort with uncertainty, but risk capacity evaluates financial ability to absorb losses—both matter equally.

Risk capacity considerations:

A 35-year-old with 30 years until retirement has enormous risk capacity regardless of tolerance

A 70-year-old living on portfolio income has limited capacity no matter how comfortable they feel with volatility

Build portfolios around capacity first, then adjust for tolerance. This prevents the catastrophic error of taking risks you financially cannot afford simply because you psychologically feel comfortable with them.

3. Automate to Override Psychology

Creating and sticking with a risk-appropriate, diversified investment plan is one of the best ways to manage the impact of market volatility. But "sticking with it" is precisely where humans fail.

Systematic approaches that work:

Automated rebalancing: Removes emotion from the sell-high, buy-low discipline that intellectually everyone endorses but behaviorally almost no one executes

Dollar-cost averaging: Through payroll deductions means you're buying during downturns without having to overcome loss aversion

Rules-based strategies: Modern platforms like Surmount allow investors to codify their strategy in advance—building systematic approaches that execute regardless of market sentiment or emotional state

You're not trusting future-you to stay disciplined during the next panic. You're making discipline automatic.

4. Focus on Process, Not Outcomes

Over a 10-year period ending December 31, 2023, the average allocation investor earned 6.3% annually while their funds produced 7.3%—a 1.1% gap attributable almost entirely to poorly timed decisions.

The critical insight? That gap wasn't random. It was:

Systematic

Directional

Driven by predictable behavioral errors

Therefore preventable

The Right Question

Stop evaluating your risk tolerance based on:

How you feel during bull markets

How brave you think you'd be during crashes

Instead, evaluate it based on what systematic process you can realistically maintain through multiple market cycles.

The right risk tolerance isn't what sounds good in a questionnaire—it's what you can actually live with when markets test you.

The Path Forward

The financial services industry has sold risk tolerance as a fixed personality trait you can measure with a 15-minute quiz. It's not. It's a complex, context-dependent, emotionally-driven phenomenon that changes with:

Market conditions

Personal circumstances

Even your mood that morning

What You Actually Need

Most investors don't need higher risk tolerance. They need:

Honest acknowledgment of the tolerance they actually have

Systematic approaches that work within those limitations rather than fighting against human nature

Process over willpower — because discipline isn't a character trait, it's a system design problem

As DALBAR's latest research confirms: whether through late re-entries, poor rebalancing, or tactical moves that missed rallies, investor behavior continues to erode real returns even in favorable markets.

The Real Question

The question isn't whether you can handle volatility. The question is whether you've built a process that handles it for you—one that operates the same whether:

The VIX is at 12 or 65

Your portfolio is up 25% or down 20%

Fear or greed dominates headlines

Because the markets will always test you. Your risk tolerance will always feel different in practice than in theory. And the gap between what you think you can handle and what you actually do will always be the most expensive lesson in investing—unless you design a system that makes the lesson unnecessary.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.