Education

You're sitting on cash. Maybe it's a bonus, an inheritance, proceeds from a home sale, or savings you've been accumulating. The question keeping you up at night isn't whether you need to do something with it—it's what and when.

The timing feels precarious. Markets are near all-time highs. Interest rates, after their aggressive 2022-2023 climb, are beginning to ease but remain elevated by historical standards. Cash savings accounts that paid nearly nothing three years ago now offer 4-5% yields. Every financial talking head has a different opinion about what comes next.

So you wait. And while you wait, you're making a decision by default.

The Hidden Cost of Sitting Still

Here's the uncomfortable truth: holding cash feels safe, but it's rarely neutral. Even when high-yield savings accounts offer attractive rates, cash loses purchasing power to inflation over time and forgoes the growth potential of invested capital.

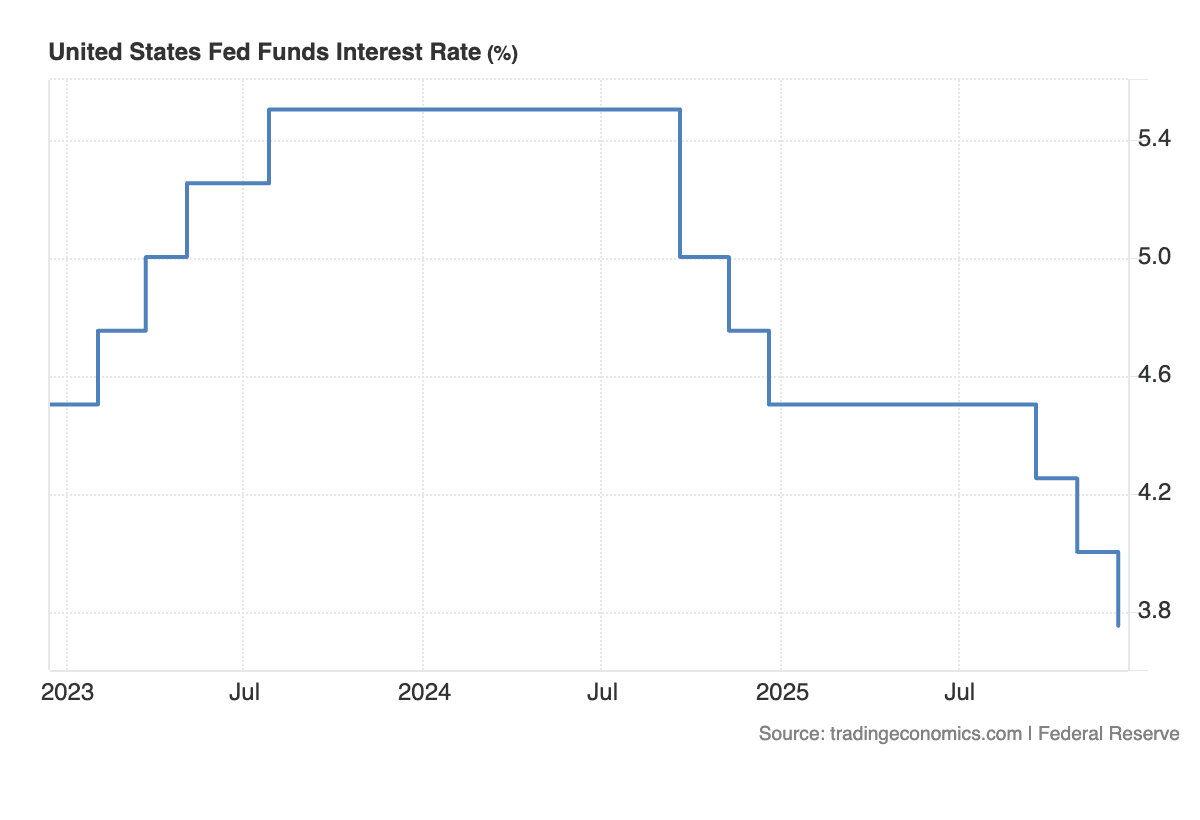

Let's ground this in current numbers. As of early 2025, the Federal Reserve has begun cutting rates after holding them at multi-decade highs. The federal funds rate target range sits at 4.25-4.50%, down from the peak of 5.25-5.50% reached in 2023. High-yield savings accounts that offered 5%+ APYs in 2023 are now trending toward 4-4.5%—and they're likely to decline further as rate cuts continue.

Meanwhile, inflation remains above the Fed's 2% target. Even with inflation cooling from 2022's peak, the Consumer Price Index rose 2.7% year-over-year as of November 2024. If your cash earns 4% nominal interest but inflation runs at 2.7%, your real return is only 1.3%. That's the actual growth in purchasing power—and it assumes rates stay elevated, which they won't.

The equity markets, despite volatility, have historically delivered far stronger returns. The S&P 500's long-term average annual return sits around 10% nominal, approximately 7% after inflation. Over extended periods, the opportunity cost of holding cash compounds dramatically.

Why 2026 Makes the Decision Harder

The post-rate-hike environment creates unique psychological friction. After watching the Fed aggressively tighten monetary policy to combat inflation, investors have been conditioned to see volatility as the norm and cash as a refuge.

Three factors amplify the paralysis:

Market valuations: The S&P 500 trades near record highs, with price-to-earnings ratios above historical averages, making many investors fear they're buying at the peak

Rate uncertainty: As the Fed pivots to cuts, the direction is clear but the pace and extent remain unknown, creating questions about both equity and fixed income positioning

Economic ambiguity: Mixed signals from employment data, consumer spending, and corporate earnings make forecasting unusually difficult

This uncertainty breeds a natural instinct to wait for clarity. The problem? Markets don't wait for clarity. They price in expectations continuously, and by the time the picture becomes clear, returns have often already been captured.

Research from Vanguard analyzing markets from 1976 to 2022 found that investors who waited for "better" entry points—attempting to time the market—underperformed those who invested available cash immediately roughly 68% of the time. The best time to invest has historically been as soon as you have capital to deploy, not when conditions feel comfortable.

The Three Paths: What the Data Actually Says

Let's examine each option through the lens of evidence rather than intuition.

Path 1: Keep It in Savings

Best for: Emergency funds, money needed within 12-18 months, true risk-averse capital

High-yield savings accounts and money market funds remain viable for short-term needs. But understand what you're optimizing for: liquidity and capital preservation, not growth.

As rate cuts continue through 2025-2026, expect yields to compress. Goldman Sachs projects the Fed will cut rates multiple times in 2025, which will directly reduce savings account yields. That 4.5% APY you're earning today could be 3% or lower by year-end 2025.

The verdict: Appropriate for short-term reserves and true emergency funds. Expensive for long-term wealth building.

Path 2: Invest Now

Best for: Long-term capital (5+ year horizon), investors with clear financial plans, those comfortable with volatility

The case for immediate investment is straightforward: time in the market beats timing the market. Historical data overwhelmingly supports deploying capital into a diversified portfolio aligned with your risk tolerance and goals.

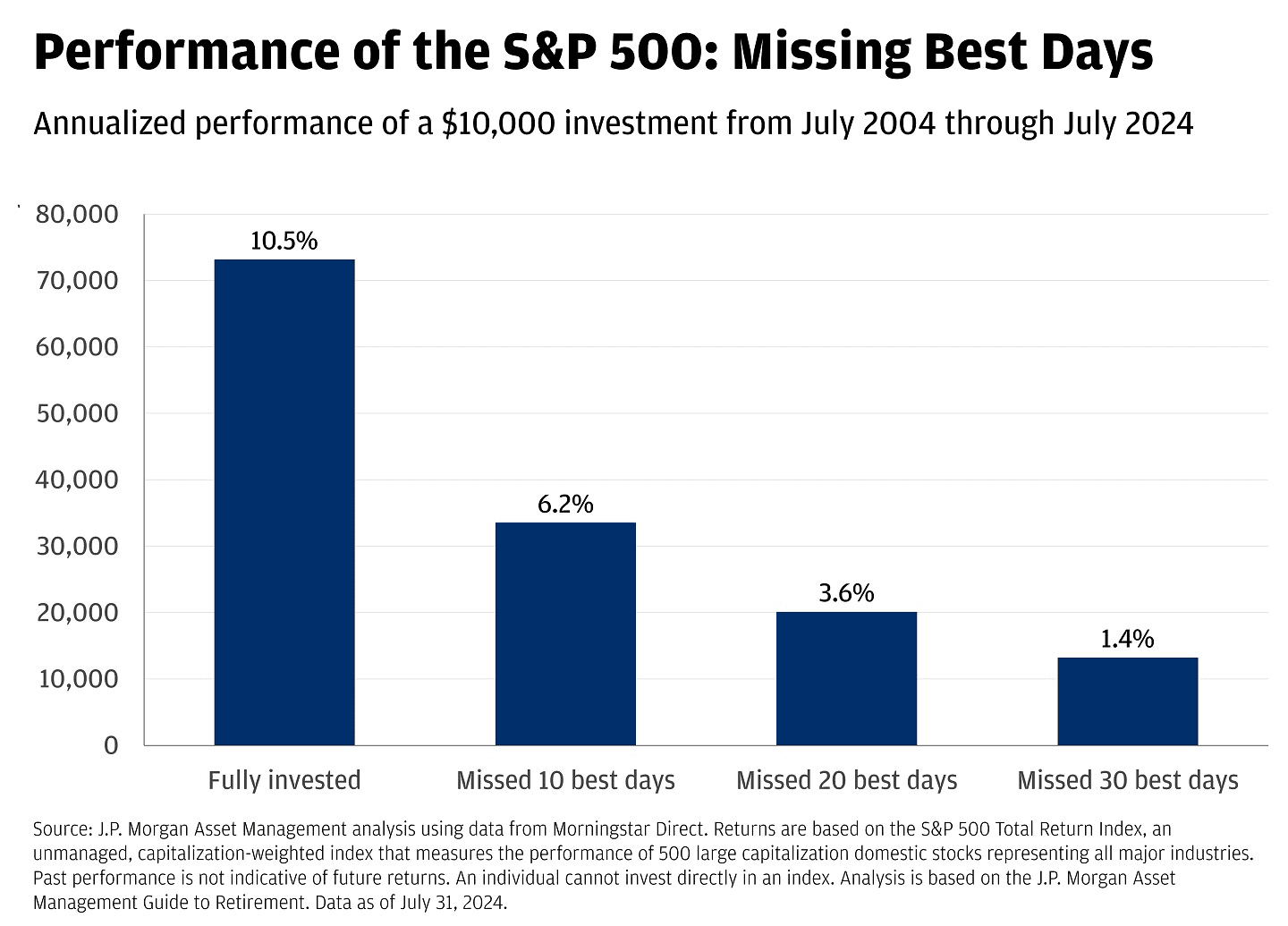

Despite current valuations, market timing has proven notoriously difficult even for professionals. The S&P 500's best days are often clustered near its worst days, and missing just a handful of the strongest days can dramatically impact long-term returns. Research from J.P. Morgan shows that missing the 10 best days in the market over a 20-year period cuts returns by more than half.

What matters more than timing:

Asset allocation: Your mix of stocks, bonds, and other assets should reflect your time horizon and risk capacity

Diversification: Broad market exposure reduces single-stock and sector risk

Rebalancing: Systematic adjustments maintain your target allocation as markets move

BlackRock's 2024 research on systematic asset allocation found that nimble approaches combining strategic tilts with tactical timing—rather than simply holding cash—generated more consistent returns across market regimes.

The verdict: Optimal for most investors with appropriate time horizons and risk management in place.

Path 3: Dollar-Cost Average Over Time

Best for: Risk-averse investors prone to panic selling, those needing psychological comfort to stay invested

Dollar-cost averaging—spreading investments over several months—doesn't improve returns in most scenarios. As covered in the research, lump sum investing outperforms DCA roughly 68-75% of the time because markets rise more often than they fall.

However, DCA serves a legitimate behavioral purpose. If gradually entering the market is the difference between investing and staying in cash indefinitely, the slight performance drag is worth paying.

The verdict: Suboptimal mathematically but valuable if it keeps you invested rather than paralyzed.

The 2026-Specific Playbook

Given current conditions, here's a framework for the cash sitting in your account:

Tier your capital by time horizon:

0-12 months needs: Keep in high-yield savings or money market funds

1-3 year goals: Consider short-duration bonds or bond funds that benefit as rates stabilize

3-5 year objectives: Balanced portfolios with meaningful fixed income allocation

5+ year capital: Equity-heavy allocations reflecting long-term growth potential

For most investors, the practical approach looks like this:

Maintain 3-6 months expenses in liquid emergency savings

Deploy longer-term capital into a diversified portfolio matching your risk tolerance

Implement systematic rebalancing rather than trying to time entries

Research from T. Rowe Price found that threshold-based rebalancing—adjusting when allocations drift beyond specific parameters—eliminated emotion from the process while capturing opportunities during volatility.

What Modern Tools Make Possible

The debate between saving and investing assumes static, manual implementation. But algorithmic strategies and automated platforms have created more sophisticated approaches:

Rules-based rebalancing that systematically buys during declines without emotional decision-making

Tax-loss harvesting that converts volatility into tax advantages

Dynamic asset allocation that adjusts to changing market conditions within defined risk parameters

These tools don't eliminate market risk, but they remove the paralysis of trying to time perfect entry points while maintaining disciplined execution regardless of headlines.

The Real Answer

The question "Should I invest or wait?" contains a flawed premise: that waiting is a neutral position. It isn't. Every day your cash sits idle is a day it's not compounding, not diversified, and not positioned for long-term growth.

The sophisticated answer isn't about predicting whether markets will be higher or lower in three months. It's about building a portfolio designed to perform across scenarios, implementing it systematically, and rebalancing with discipline.

If you have cash earmarked for long-term goals, deploy it into an appropriate asset allocation now. If market volatility makes you genuinely uncomfortable, spread the deployment over a few months to ease the psychological burden. But don't confuse patience with procrastination.

The cost of being wrong about short-term market direction pales in comparison to the cost of missing years of compound growth because you were waiting for perfect clarity that never comes.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.