Education

The explosion of algorithmic trading platforms has democratized sophisticated investment strategies. But here's the uncomfortable truth: most strategies that look brilliant in backtests crumble when exposed to real markets.

The difference between profitable trading and portfolio destruction often comes down to vetting strategies before risking capital. Understanding which metrics matter, which red flags scream danger, and which green flags signal genuine edge can save you from expensive mistakes.

The Backtest Illusion: When Perfect Is a Problem

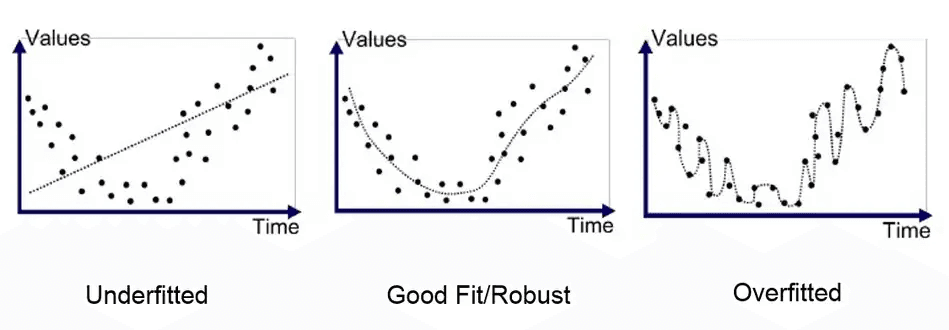

If your backtest looks too good to be true, it probably is. Markets are messy and unpredictable. A strategy showing smooth upward curves with minimal drawdowns and triple-digit returns? That's overfitting, not skill.

Critical red flags of overfitting:

Unrealistic returns: Triple-digit annual gains with minimal drawdowns

Too-smooth equity curves: Real strategies experience volatility and gut-punch moments

Inconsistent cross-asset performance: Works on Apple but fails on Microsoft

Excessive complexity: Dozens of parameters create overfitting magnets

Poor out-of-sample results: Studies found 44% of published strategies couldn't replicate success on new data

Overfitting means the strategy memorized past price movements rather than learning genuine market principles. It captured noise, not signal.

The Risk-Adjusted Metrics That Actually Matter

Absolute returns tell an incomplete story. A 50% annual gain with 60% drawdowns would psychologically destroy most traders. Sophisticated investors focus on risk-adjusted performance metrics.

Sharpe Ratio: The Industry Standard

The Sharpe Ratio measures return per unit of volatility.

Formula: (Portfolio Return - Risk-Free Rate) / Standard Deviation

Interpretation:

Sharpe > 2.0: Excellent

Sharpe 1.0-2.0: Good, acceptable

Sharpe < 1.0: Poor risk-reward relationship

Limitation: Penalizes both upside and downside volatility equally.

Sortino Ratio: Isolating Downside Risk

The Sortino Ratio improves on Sharpe by only penalizing negative movements below a target return.

Why it matters:

Aligns with investor psychology (we welcome upside volatility)

Provides accurate risk assessment for asymmetric returns

Better for capital preservation-focused strategies

A Sortino > 2.0 indicates strong returns without excessive downside risk.

Calmar Ratio: The Drawdown Reality Check

The Calmar Ratio evaluates returns relative to maximum drawdown—the largest peak-to-trough decline.

Formula: Annualized Return / Maximum Drawdown

Interpretation:

Calmar > 3.0: Excellent

Calmar 1.0-3.0: Acceptable

Calmar < 1.0: Warning—losses exceed returns

Maximum drawdowns devastate compounding. Research shows:

30% drawdown requires 42.9% gain to break even

50% drawdown requires 100% gain to recover

60% drawdown requires 150% gain to return to breakeven

Maximum Drawdown: The Non-Negotiable Metric

Maximum drawdown (MDD) reveals a strategy's true character—the largest percentage decline from peak to trough before a new peak emerges.

MDD < 10%: Conservative, low-risk

MDD 10-20%: Moderate risk, acceptable for most

MDD 20-30%: Aggressive, requires strong tolerance

MDD > 30%: High risk, consider if recovery is realistic

Critical questions:

Can you emotionally handle this loss without abandoning the strategy?

Does your capital structure support this drawdown?

How long did recovery take historically?

Win Rate Versus Payoff: The Balance That Matters

Many traders obsess over win rate—but win rate alone tells you nothing about profitability.

A strategy winning 80% of the time sounds impressive until winners average $100 while losers average $600. That's portfolio destruction despite frequent wins.

The expectancy equation:

Average Profitability = (Win Rate × Average Win) - (Loss Rate × Average Loss)

Examples:

Scenario A: 30% win rate, 3:1 payoff ratio = Potentially profitable

Scenario B: 70% win rate, 1:3 payoff ratio = Likely unprofitable

Research shows you need approximately 80% win rate to compensate for a 1:3 risk-reward ratio.

Sample Size and Statistical Significance

A strategy showing 10 consecutive winners means nothing statistically. You need sufficient trade sample size to distinguish skill from luck.

Guidelines:

< 30 trades: Statistically meaningless

30-100 trades: Minimal relevance

100-300 trades: Reasonable confidence

> 300 trades: Strong statistical foundation

Out-of-Sample Testing: Your First Defense

The first defense against curve-fitting is out-of-sample testing—validating performance on unseen data.

Proper methodology:

In-sample: 70-80% of data for development

Out-of-sample: 20-30% held back for validation

Never optimize using out-of-sample data

Green flags:

Performance degrades < 20% from in-sample

Sharpe/Sortino ratios remain positive

Maximum drawdown stays within parameters

Red flags:

Dramatic performance collapse

Negative returns after stellar in-sample results

Complete failure during regime changes

Parameter Sensitivity: The Stability Test

Parameter sensitivity testing reveals whether you've found genuine edge or lucky numbers.

Green flags—robust parameters:

Performance degrades gradually with changes

Strategy remains profitable across parameter ranges

Multiple combinations deliver acceptable results

Red flags—curve-fitted parameters:

Minor changes destroy profitability

Single "magic" parameter set far outperforms others

No logical explanation for why parameters work

Green Flags: What Robust Strategies Look Like

Hallmarks of quality strategies:

Logical foundation:

Clear explanation for why the edge exists

Based on observable market behavior

Exploits genuine inefficiencies

Consistent across dimensions:

Multiple assets showing similar results

Various timeframes producing comparable performance

Multiple years of validation

Realistic performance:

Moderate, sustainable returns

Drawdowns proportionate to gains

Sharpe ratio > 1.0, ideally > 1.5

Statistical significance:

Large trade sample (hundreds minimum)

Positive expectancy across subperiods

Performance not dependent on outliers

The Modern Vetting Solution

Surmount exemplifies platforms built specifically to help investors vet strategies with institutional-grade rigor.

Comprehensive metrics display:

Every strategy shows the analytics that separate professionals from amateurs:

Sharpe, Sortino, and Calmar ratios

Maximum drawdown with recovery analysis

Win rate, expectancy, and profit factor

Detailed trade distribution

Backtesting transparency:

Complete visibility into performance:

Full historical backtests across market regimes

Out-of-sample validation results

Performance by market condition

Trade-by-trade analysis

Built-in robustness testing:

Recent enhancements address vetting challenges:

Improved backtesting speed for parameter testing

Alternative data integration including sentiment analysis

Dynamic rebalancing adapting to conditions

Multi-asset validation

Three sophistication levels:

No-code: Browse verified strategies, compare metrics, deploy with transparency

Low-code: Modify strategies visually, test variations, validate through backtesting

Full Python: Build custom strategies, access complete data, implement advanced risk management

The marketplace advantage:

Strategy creators can monetize successful algorithms, creating incentive alignment:

Creators often trade their own strategies

Real money validates backtest claims

Competition drives refinement

Access diversified uncorrelated strategies

Before deployment, you see comprehensive metrics, complete backtests, and risk analyses. No hidden performance. No cherry-picked periods.

Making Better Decisions

The metrics we've explored—Sharpe, Sortino, Calmar, maximum drawdown, win rate, expectancy—aren't just numbers. They're your defense against expensive mistakes.

Key principles:

Skepticism beats optimism: Question perfect backtests

Context matters: Understand regimes, costs, constraints

Metrics work together: No single measure tells all

Robustness trumps optimization: Strategies working across conditions win

Transparency is non-negotiable: Demand complete visibility

Whether evaluating marketplace strategies or building custom algorithms, these principles remain constant. Successful algorithmic trading requires marrying sophisticated technology with rigorous analytical discipline. At Surmount, every strategy on our platform undergoes the same rigorous vetting process outlined above. Investors can view key risk-adjusted metrics like Sharpe, Calmar ratios, alongside detailed drawdown analyses, trade distributions, and out-of-sample results—all before allocating a single dollar. Transparency and data integrity aren’t afterthoughts; they’re the foundation of how we help investors separate genuine edge from illusion.

The tools exist. The strategies exist. The question is whether you'll invest time to vet them properly—or learn expensive lessons in live trading that backtesting should have taught you for free.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.