Education

Every January, headlines scream about recession risks. Economists trot out forecasts. Market pundits offer predictions. And investors are left wondering: should I be worried?

Here's the calm, data-driven answer for 2026: probably not—but the story is more nuanced than any single number suggests.

What the Consensus Says

The economic forecasting community has converged on a relatively optimistic baseline for 2026:

Goldman Sachs: 20% recession probability, down from 30% in late 2025

RSM: 30% recession odds, down from 40%

Moody's Analytics: 42% probability, though chief economist expects economy to avoid downturn

Bloomberg Survey: Consensus of 30% recession risk with 2% GDP growth forecast

Bankrate Survey: Average odds of 28% across major economists

The average across major forecasts puts recession odds around 28-30%—elevated compared to normal times (typically 15%), but hardly a certainty.

Why Growth Continues (For Now)

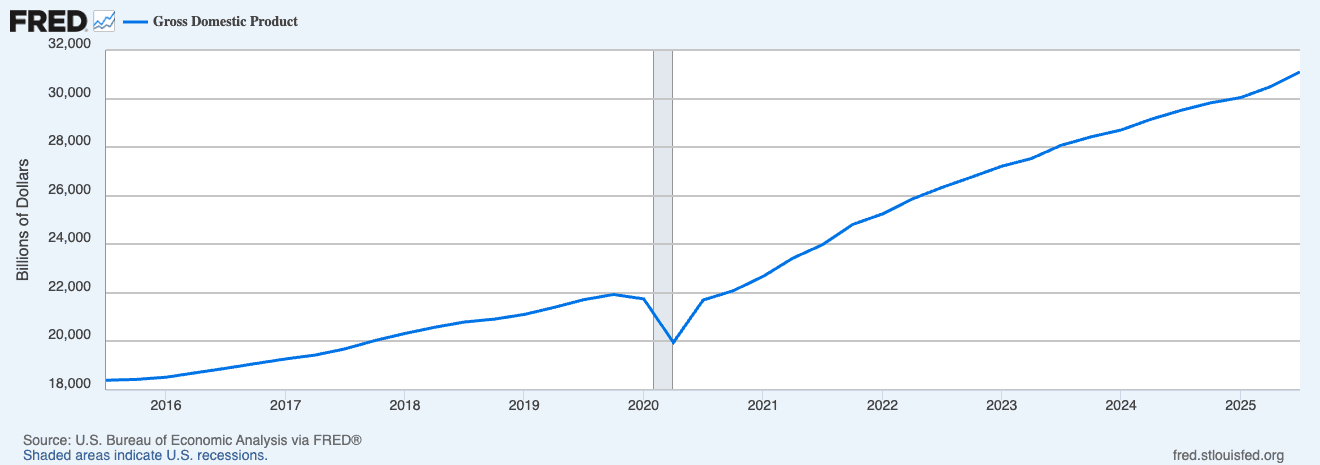

The U.S. economy demonstrated surprising resilience in 2025. Real GDP grew at 4.3% annualized in Q3 2025, the fastest pace in two years. Several factors support continued expansion:

Tax cuts and fiscal stimulus

The One Big Beautiful Bill Act passed in summer 2025 includes both business and personal tax cuts that economists expect to boost consumer spending and business investment.

AI-driven capital spending

Unprecedented investment in AI infrastructure, data centers, and advanced computing continues driving growth, though Deloitte warns that a drop in AI spending could trigger recession.

Easing tariff drag

After spiking in early 2025, many tariff rates have been reduced or deferred. Economists estimate the tariff drag that subtracted nearly 1% from growth in 2025 will fade in 2026.

Consumer spending resilience

Despite squeezed budgets for many households, aggregate consumer spending—which comprises 70% of GDP—remains solid, driven heavily by upper-income households.

The Warning Signs Worth Watching

Optimism doesn't mean complacency. Several concerning indicators demand attention:

Labor market cooling

Job gains slowed dramatically from pandemic-era levels

Unemployment rate ticked up to 4.4% in December 2025

Employers added just 49,000 jobs monthly over the past year

K-shaped economy

Wealthy households and AI-related companies thrive

Lower-income households face intensifying pressure from elevated prices and interest rates

This bifurcation creates economic fragility

Persistent inflation

Inflation remains at 2.7%, stubbornly above Fed's 2% target

Limits Fed's ability to aggressively cut rates if growth falters

Constrains recession-fighting toolkit

Sentiment disconnect

Consumer confidence measures worse than 96% of months since 1978

One-third of Americans think their finances will worsen in 2026

Despite solid economic data, pessimism runs deep

The Indicators That Cried Wolf

Traditional recession indicators have been sending false signals for years:

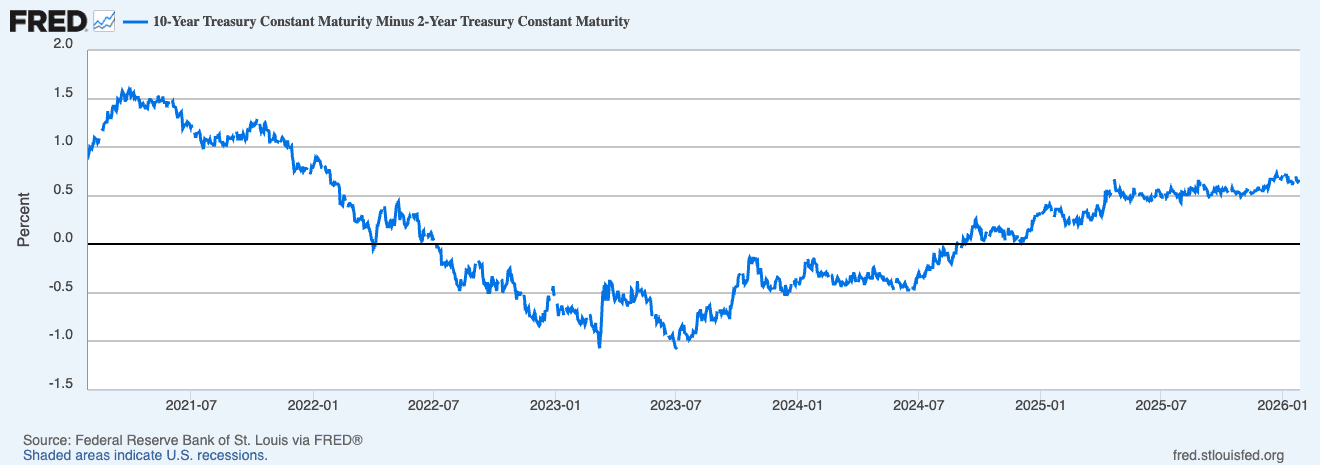

Yield curve inversion

The 10-year Treasury minus 2-year Treasury spread inverted in July 2022 and stayed negative for nearly two years—the longest inversion since 1978. Historically, this preceded every recession since the 1970s. Yet here we are in 2026, with the curve normalized and no recession materialized.

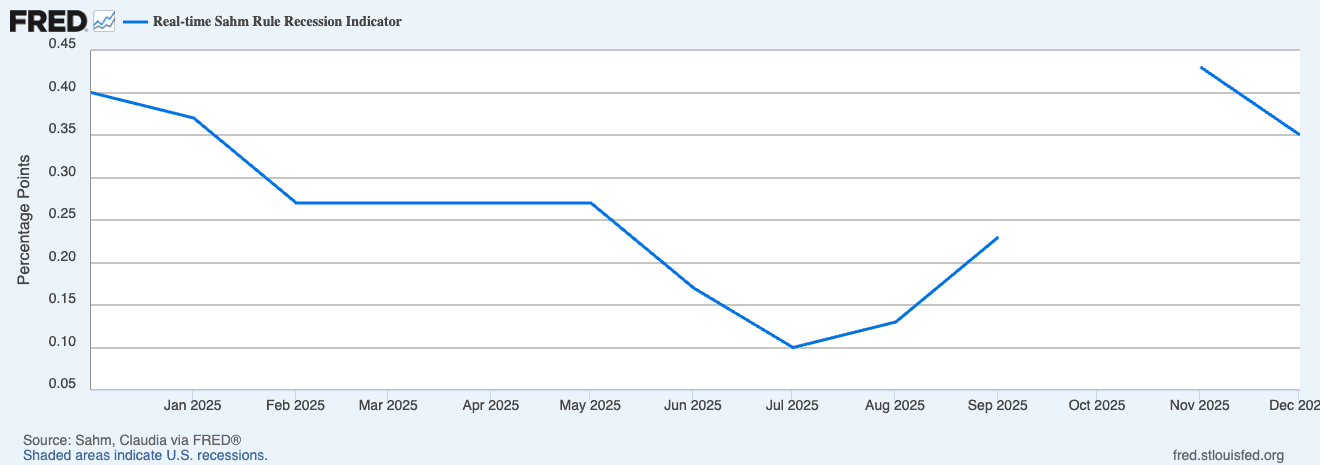

Sahm Rule trigger

This unemployment-based recession indicator triggered in 2024 when unemployment rose 0.5 percentage points from its low. Again, no recession followed.

Leading Economic Index

The Conference Board's LEI showed persistent declines through 2024 and early 2025, traditionally signaling imminent downturn. Growth accelerated instead.

What explains these failures? The unprecedented monetary policy interventions of the past 15 years—quantitative easing, near-zero rates, massive fiscal stimulus—may have fundamentally altered how these indicators function.

The Range of Outcomes

Rather than fixating on a single probability, consider the range:

Upside scenario (20-25% probability)

Tax cuts and AI productivity gains drive stronger-than-expected growth

Inflation falls quickly, allowing aggressive Fed rate cuts

GDP growth exceeds 2.5%

Unemployment stabilizes below 4.5%

Baseline scenario (50% probability)

Moderate growth around 2% with gradual labor market softening

Inflation slowly converges to target

Mild expansion continues but feels underwhelming due to K-shaped dynamics

Downside scenario (25-30% probability)

One pillar (labor market, inflation, consumer, AI) falters significantly

Tariff costs hit harder than expected

AI investment bubble corrects

Fed policy proves too tight for too long

Brief, shallow recession results

What This Means for Investors

Recession worrying is exhausting and often counterproductive. Here's the rational approach:

Don't time the recession

Even if recession odds were 50%, timing market entry and exit around economic cycles is notoriously difficult and costly.

Maintain diversification

Balanced portfolios weathered 2022's simultaneous stock-bond decline and thrived in 2025's recovery.

Keep quality cash reserves

With high-yield savings paying 4%+ and T-bills in similar range, maintaining liquidity costs nothing in real terms while providing flexibility.

Focus on long-term

Whether recession arrives in Q2 2026, Q4 2026, or 2027 matters far less than whether your portfolio is positioned for the next 10-20 years.

The Bottom Line

The data suggests 2026 will most likely see continued modest growth rather than contraction. Goldman Sachs projects 2.5% GDP growth for the year, above consensus estimates. Even if recession arrives, it's unlikely to resemble the deep downturns of 2008 or 2020.

The Fed has 375 basis points of cutting room if needed—a luxury they lacked during the 2010s. Markets have proven remarkably resilient through tariff shocks, yield curve inversions, and labor market cooling.

Worry less. Plan more. Focus on what you control.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.