Education

Every investor knows the cardinal rule: don't put all your eggs in one basket. Yet nearly 90% of Americans hold concentrated stock positions, with many having over half their net worth tied to a single company. The true cost of overconcentration isn't just what you might lose in a downturn—it's what you systematically fail to capture in every market cycle, year after year.

The Math Working Against You

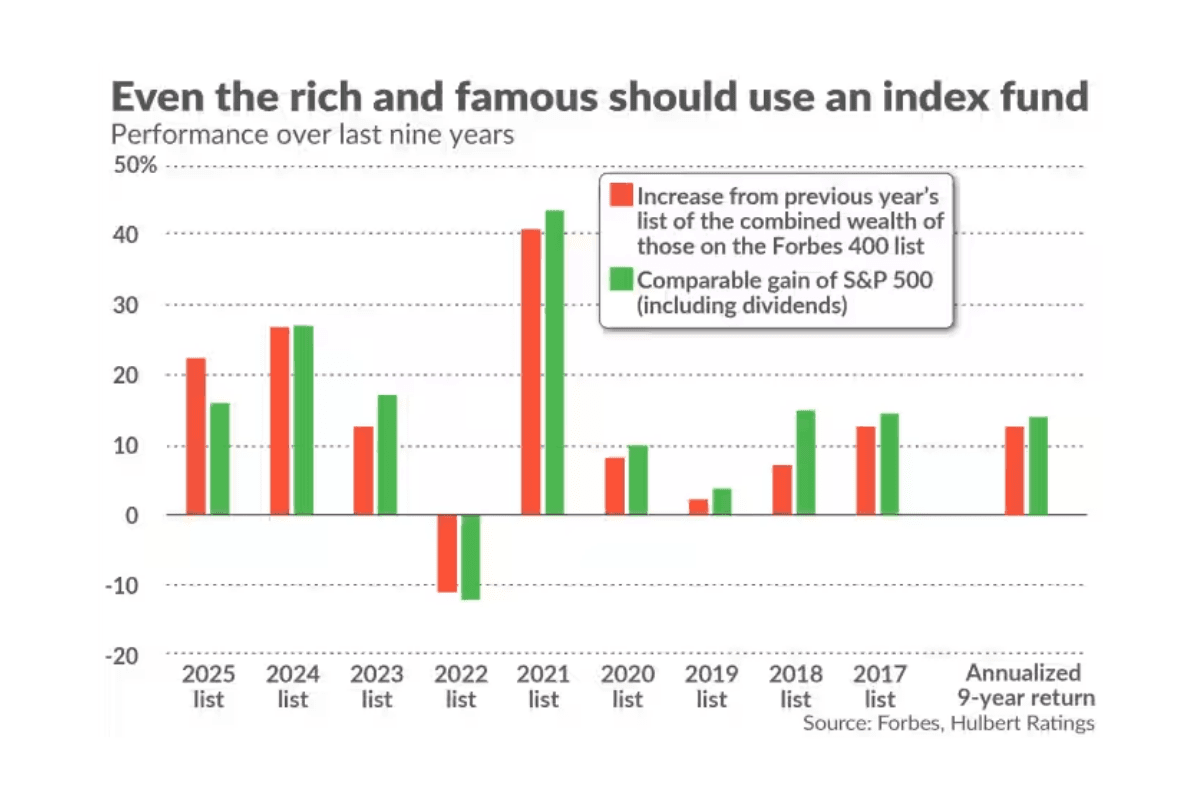

Between 1980 and 2020, nearly 60% of individual stocks underperformed the Russell 3000 index. More striking: just 4% of companies accounted for the entire net gain in the US stock market over that period.

The mathematics compound brutally:

Recovery asymmetry: A 50% loss requires a 100% gain just to break even

Sharpe ratio deterioration: Vanguard research shows portfolios with 20%+ in a single stock see significantly worse risk-adjusted returns

Opportunity cost: Diversified portfolios capture winners across sectors you never anticipated

A concentrated portfolio requires you to be right about specific companies, specific management teams, and specific competitive dynamics—repeatedly.

The Sector Trap Nobody Sees Coming

Holding five different tech stocks isn't diversification—it's amplifying the same systemic risk. JPMorgan Asset Management data reveals that sector correlations surge to 0.90+ during stress periods, meaning "different" companies move in lockstep.

Technology stocks in 2022 demonstrated this acutely: growth equities broadly declined 25-35% while energy thrived. Geographic concentration creates similar hazards—S&P Global research shows adding international exposure reduces volatility 8-12% while maintaining comparable returns.

The paradox: investors accept concentration in familiar sectors while avoiding uncorrelated assets that would actually reduce risk.

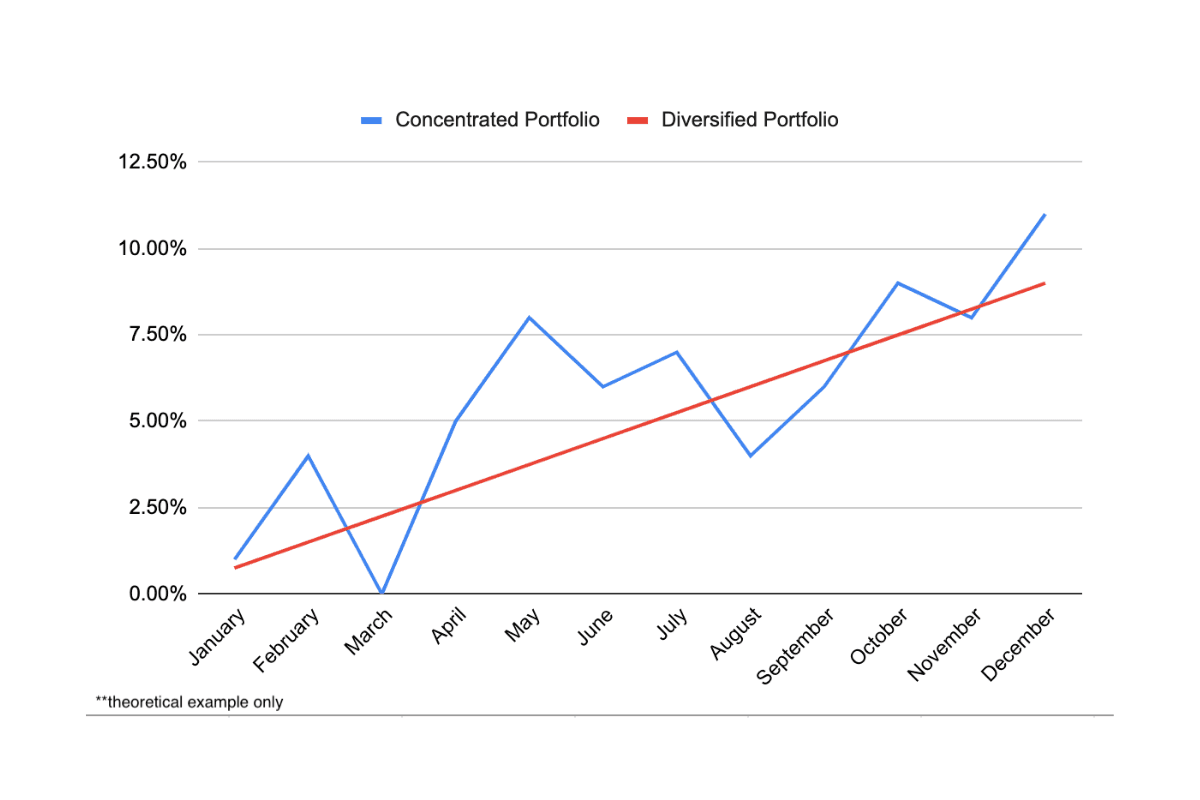

Volatility's Hidden Compound Tax

Standard deviation only tells part of the story. Research in the Journal of Portfolio Management shows concentrated portfolios experience drawdowns 40-60% deeper than diversified peers during market stress.

The recovery timeline destroys wealth:

Diversified portfolio (-20%): 8-10 month median recovery

Concentrated position (-40%): 3.5 year median recovery—if it recovers at all

During those years underwater, you're missing compounding opportunities and likely making behavioral errors. Morningstar studies found investors in concentrated positions are twice as likely to sell at the bottom, crystallizing losses rather than weathering volatility.

The Tax Trap That Compounds for Decades

Concentration creates structural tax drag that persists across decades. Vanguard's tax-managed research demonstrates concentrated positions prevent:

Tactical rebalancing without triggering taxable events

Tax-loss harvesting that adds 50-100 basis points annually to after-tax returns

Strategic allocation shifts as market conditions change

The psychological trap: that $500,000 embedded gain feels prohibitive to diversify at a 40% combined tax rate. Yet the opportunity cost of remaining concentrated—reduced volatility, better Sharpe ratios, rebalancing alpha—often exceeds the tax hit over 10-15 years.

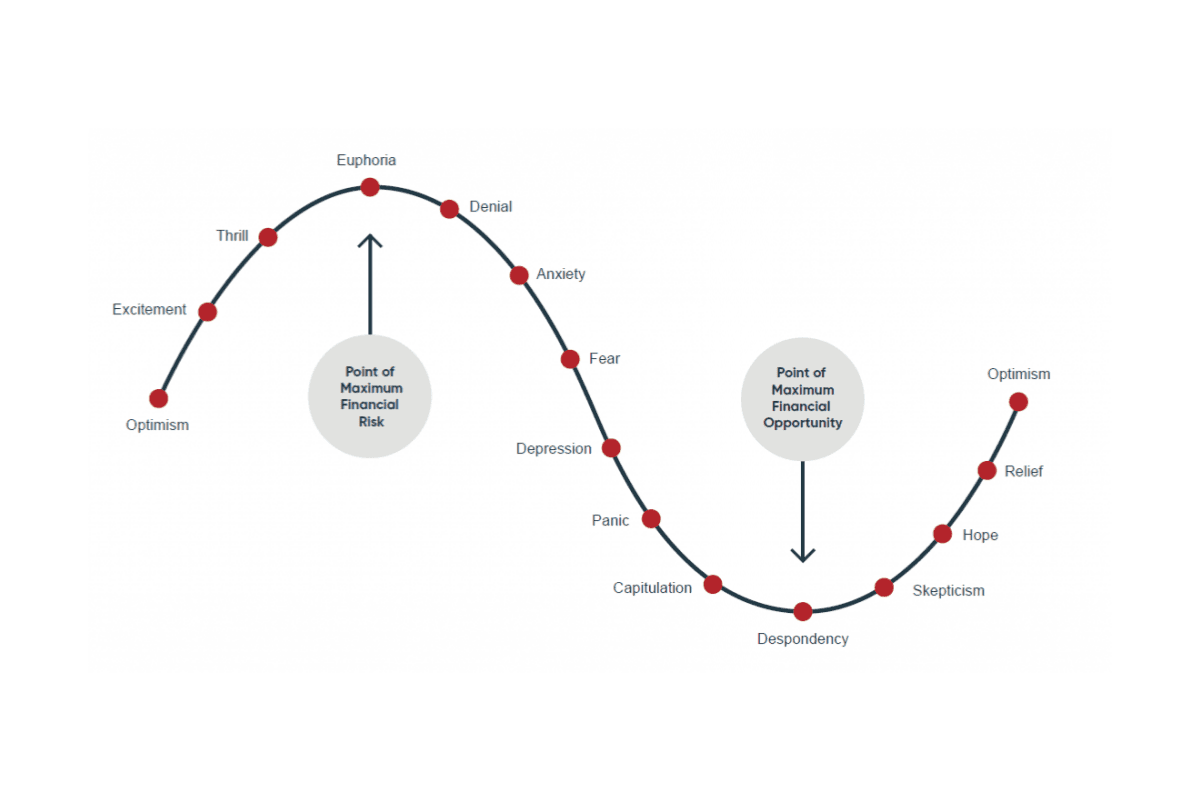

Behavioral Biases Make Everything Worse

Research in the Quarterly Journal of Economics found investors routinely overweight concentrated holdings in mental accounting, treating their "core position" differently than other investments.

This triggers cascading biases:

Endowment effect: You value what you own more than market price suggests

Familiarity bias: You know the company, therefore you overestimate stability

Confirmation bias: You selectively attend to positive news while dismissing concerns

Fidelity analysis shows investors hold concentrated positions 3.2 years longer than originally intended, repeatedly postponing diversification while risk compounds.

What Proper Diversification Actually Captures

Dimensional Fund Advisors research tracking 1995-2020 found globally diversified portfolios delivered 94% of concentrated "winner" returns with 40% less volatility—a dramatically superior risk-adjusted profile.

The advantages compound:

Sector rotation capture: Participate in whatever's working rather than predicting it

Downside protection: 10-15 low-correlation positions reduce portfolio volatility 20-30%

Rebalancing alpha: Mechanical buying low and selling high adds 35-50 basis points annually

Reduced financial stress: Fewer emotionally-driven decisions during volatility

Modern tools enable systematic diversification that adapts to changing correlations, rebalances tax-efficiently, and integrates multiple asset classes without requiring full-time attention. The shift is from "What's my best idea?" to "What's my most robust portfolio?"

Beyond Traditional 60/40

AQR Capital Management research demonstrates that adding alternatives, commodities, and global real assets reduces drawdowns 15-25% while maintaining comparable long-term returns. The correlation benefits matter more than individual asset performance.

During 2022's equity decline, traditional 60/40 portfolios suffered because bonds fell alongside stocks. Portfolios with broader diversification across managed futures, real assets, and alternative strategies demonstrated resilience precisely because some components thrived in that environment.

Modern platforms enable this exposure through liquid vehicles. The barrier isn't access—it's the inertia of familiar concentration.

Concentration feels like conviction. It feels like you've identified the winner and maintained discipline. But data across decades tells a different story: concentration systematically underperforms diversification on a risk-adjusted basis, creates tax inefficiency, amplifies behavioral mistakes, and exposes investors to tail risks their mental models underestimate.

The question isn't whether your concentrated position could work out. It's whether you're being adequately compensated for the structural disadvantages you're accepting—disadvantages that compound across years in ways that become apparent only when it's too late to correct course efficiently.

Modern investing rewards systematic approaches over heroic bets. Platforms enabling algorithm-driven portfolio construction, automatic rebalancing, and tax-efficient diversification implement the discipline that concentration makes impossible. That might be less emotionally satisfying than holding your best idea. But it's how compound wealth actually gets built.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.