Education

The landscape of personal wealth management is undergoing a fundamental transformation. Between the Federal Reserve's cautious rate adjustments, artificial intelligence automating once-manual financial decisions, and millions of Americans supplementing their incomes through side work, the traditional playbook for building wealth is being rewritten in real time.

For investors and savers, 2026 represents an inflection point where technology, policy, and labor dynamics converge to create both challenges and genuine opportunities for those willing to adapt.

Interest Rates: The Era of Strategic Stability

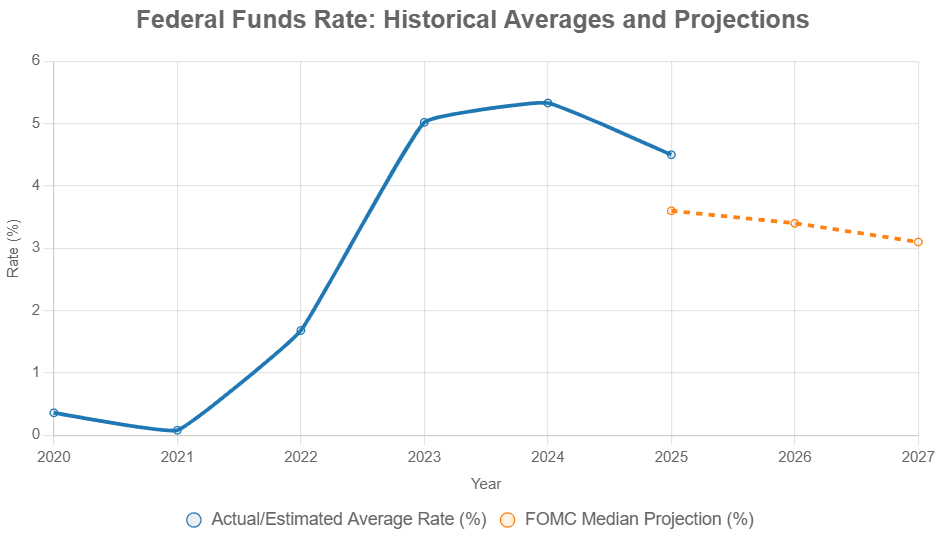

After three consecutive rate cuts in 2025, the Federal Reserve has signaled a more measured approach for 2026. The central bank's current target range sits at 3.5% to 3.75%, with projections pointing toward just one or two additional quarter-point reductions throughout the year.

What makes this moment particularly interesting:

The Fed projects minimal movement in 2026, while independent analysts like Goldman Sachs anticipate rates settling in the 3% to 3.25% range

The Congressional Budget Office projects rates will reach approximately 3.4% by the end of 2028

Despite short-term rate cuts, the 10-year Treasury yield is projected to climb from 4.1% to 4.3% through 2028, influencing mortgage rates and corporate borrowing costs

For practical purposes, the window for locking in today's higher yields is narrowing. Certificates of deposit offering 4% annual percentage yields won't remain competitive indefinitely. The strategic move isn't to wait for lower rates—it's to capitalize on current conditions before they soften.

AI-Driven Finance: From Buzzword to Balance Sheet

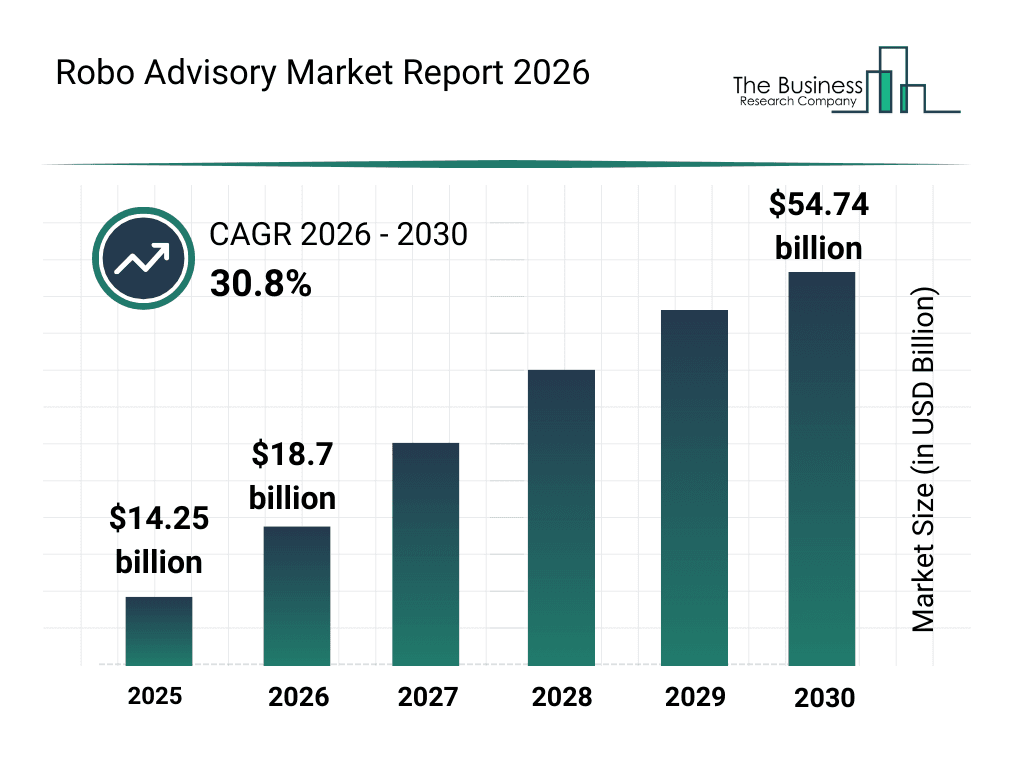

The robo-advisor market tells a story of maturation rather than disruption. The market is projected to surge from $8.01 billion in 2024 to $33.38 billion by 2030, but the real evolution is in capability.

Today's AI-powered financial tools deliver:

Daily tax-loss harvesting that captures micro-dips human advisors would never spot

Direct indexing that allows investors to own individual stocks rather than ETF wrappers

Conversational interfaces that analyze 10,000+ data points daily to score investment opportunities

Automated fraud detection and fee analysis that uncovers hidden charges costing investors hundreds of thousands over a lifetime

The limitation remains unchanged: algorithms don't understand context. They can't weigh whether sustainable investing matters more to you than maximum returns or navigate the emotional complexity of competing financial goals.

This is why the hybrid model now dominates—platforms combining automated portfolio management with human advisor access. It's not AI replacing advisors; it's AI handling computational heavy lifting so human expertise can focus on decisions that actually require judgment.

The Side Hustle Economy: Necessity Meets Opportunity

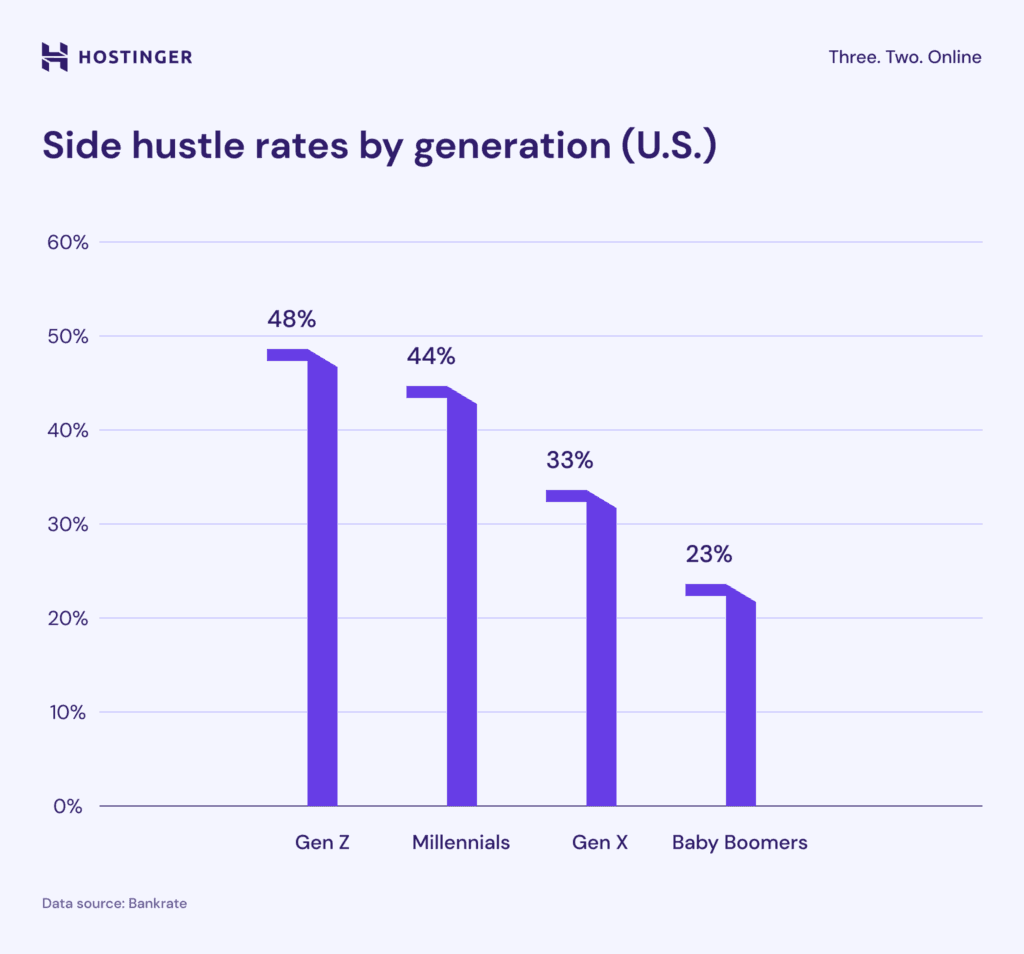

More than 39% of working Americans now maintain a side hustle, representing roughly 80 million people. The global gig economy reached $582.2 billion in 2024 and is projected to hit $674.1 billion in 2026.

Key income realities:

Average monthly side hustle income ranges from $442 to $891, depending on skill level and work type

Rideshare services earn $16 to $23 per hour

Specialized freelance work commands $50 to $150 per hour

The interesting development in 2026 isn't the existence of side work—it's the sophistication of approach. Workers increasingly treat side hustles as skill-building laboratories rather than just income supplements. With the World Economic Forum projecting that 39% of current workplace skills will be transformed or obsolete by 2030, side projects offer a low-risk way to develop marketable capabilities.

What's often overlooked: side income, when invested rather than spent, accelerates wealth building in ways that salary alone cannot. An extra $500 monthly invested consistently at historical market returns compounds into substantial six-figure sums over working careers.

Tax Policy: Navigating the OBBBA Landscape

The One Big Beautiful Bill Act, signed into law in July 2025, introduces significant changes affecting 2026 tax returns filed in early 2027.

Major changes for investors:

Standard deductions rise to $32,200 for married couples and $16,100 for single filers

New $6,000 senior deduction for taxpayers 65 and older (with income phase-outs)

State and local tax deduction cap quadrupled from $10,000 to $40,000 for 2025

401(k) contribution limit increased to $24,500 for 2026

Workers aged 60-63 can make catch-up contributions of $11,250

These changes mean tax planning becomes more valuable. The expanded SALT deduction makes itemizing worthwhile for more taxpayers, while enhanced retirement contribution limits create larger immediate tax benefits for high earners.

Building Wealth in the New Environment

The convergence of stable-but-higher interest rates, AI-enabled financial tools, diversified income streams, and revised tax policy creates a distinct opportunity set for 2026.

Strategic moves to consider:

Lock in current fixed-income yields before rates decline further

Leverage automated investment platforms for tax optimization and portfolio management

Treat side income as wealth-building fuel rather than lifestyle spending

Maximize retirement contributions within expanded 2026 limits

Review itemized deductions to capture SALT and other expanded benefits

The broader principle underlying these shifts is intentionality. The default path—where money sits in low-yield checking, investment decisions happen sporadically, and tax returns get filed without strategic planning—leaves substantial value on the table.

Platforms like Surmount exemplify this new paradigm. By enabling both investors and advisors to design, test, and deploy automated investment strategies without coding, they eliminate the traditional barrier between sophisticated quantitative approaches and practical implementation. It's the same democratization principle driving robo-advisors and gig platforms, applied to strategy creation itself.

The most successful investors in 2026 won't be those who predict market direction or time economic cycles. They'll be those who build systems that capitalize on structural advantages, automate disciplined behavior, and compound incremental gains into meaningful wealth. That's not prophecy—it's just math, executed consistently.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.