Education

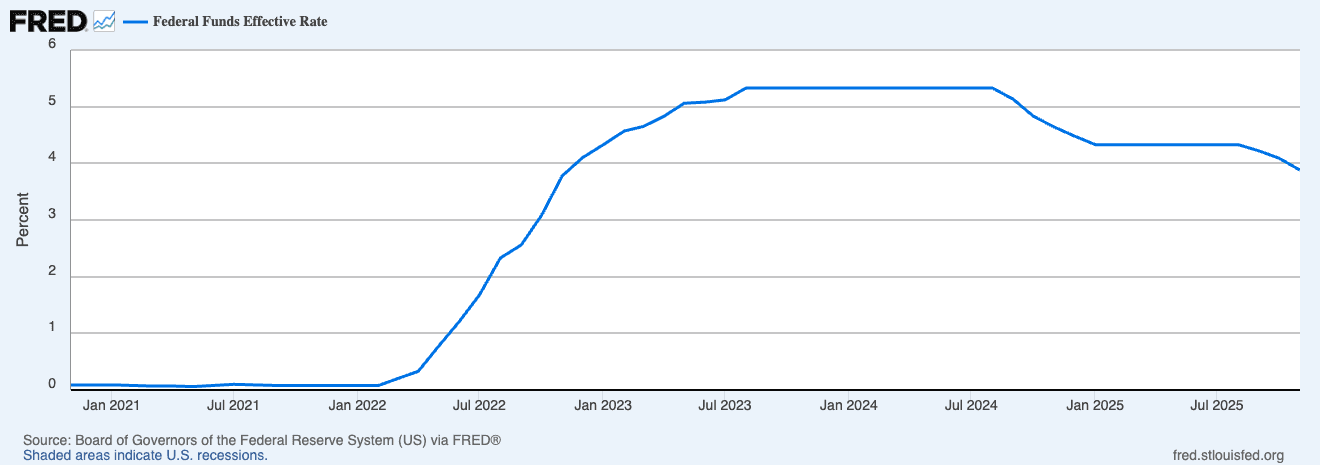

The era of near-zero interest rates is over. After more than a decade of historically low borrowing costs, the Federal Reserve has held interest rates at 4.25%-4.50% as of March 2025, marking a dramatic shift from the 0%-0.25% range that prevailed during the pandemic.

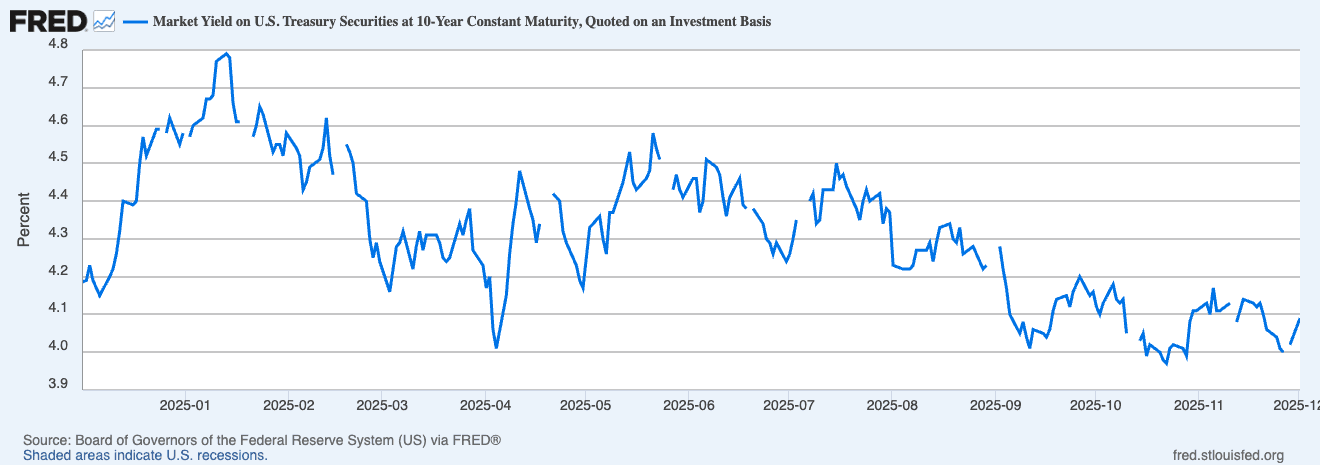

This isn't a temporary blip. The 10-year Treasury yield averaged 4.2% in 2024 and 4.3% as of June 2025, compared to just 2.4% from 2010-2019. We've entered what many economists call a "higher-for-longer" rate environment—and it's reshaping how smart investors manage their money.

The question isn't whether rates will come down. The Fed has projected two rate cuts in 2025, but even with those cuts, we're nowhere near returning to the ultra-low rates of the past decade. The question is: how do you build wealth when the rules of the game have fundamentally changed?

The New Reality: Why Rates Aren't Going Back to Zero

First, let's understand what's different. In 2024, the Fed cut rates by 100 basis points from September through December, bringing them down from 5.5% to the current 4.25%-4.50% range. But inflation remains stubbornly above the Fed's 2% target, and core inflation stood at 2.6% year-over-year in January 2025.

What this means for you:

Savings accounts matter again: After years of earning essentially nothing, money market funds and high-yield savings accounts are finally compensating savers for taking minimal risk

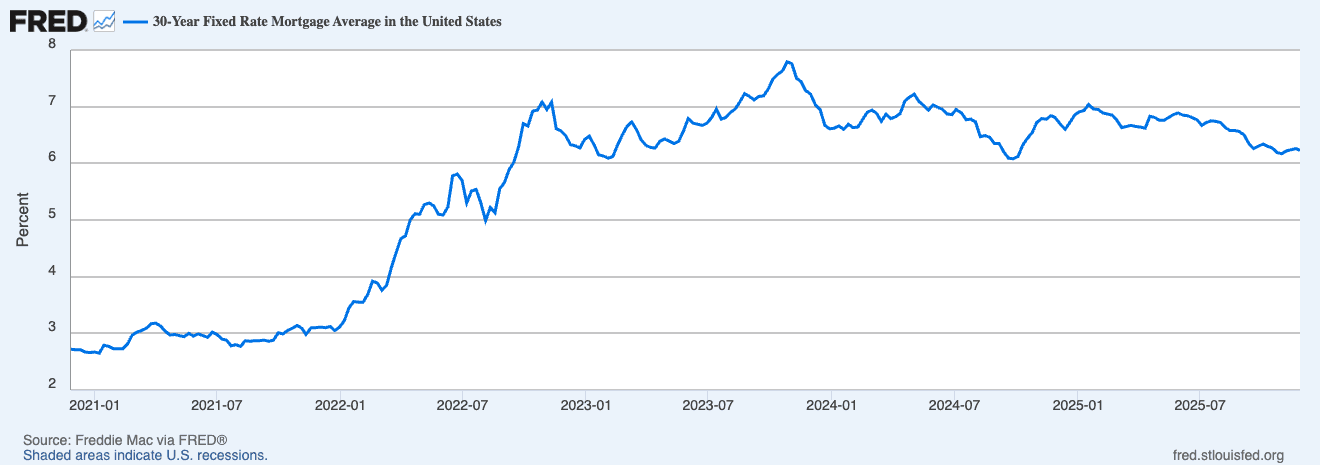

Borrowing costs have real consequences: The average 30-year mortgage rate stood at 6.8% as of June 2025, making home affordability a genuine concern

Portfolio construction needs rethinking: The strategies that worked in a zero-rate world don't necessarily work now

As of Q3 2024, 82.8% of homeowners with mortgages had rates below 6%—creating a "lock-in effect" where people can't afford to sell or refinance, fundamentally altering housing and credit markets.

Where to Put Your Cash: The Return of Fixed Income

For more than a decade, bonds were the investment world's wallflower—low yields, interest rate risk, and little upside. That's changed dramatically.

Bonds Are Back

Fixed income markets passed a milestone on October 23, 2024, when the Bloomberg U.S. Aggregate Bond Index began outyielding 3-month Treasury bills for the first time since January 2023. Translation: investors are finally being compensated for taking on duration and credit risk.

Why bonds deserve a fresh look:

Starting yields matter: The Bloomberg U.S. Aggregate Index now yields nearly 5%, providing a cushion against interest rate volatility

Diversification that actually works: During the August 2024 market selloff, bonds fulfilled their traditional role as portfolio ballast when equities stumbled

Income without excessive risk: Short-term investment-grade credit returned 5% in 2024, while high-yield delivered nearly 8%—despite significant rate volatility

The Rebalancing Opportunity

Here's an uncomfortable truth: A typical 60/40 stock-bond portfolio from 2019, without rebalancing, would now be a 79/21 portfolio due to strong equity returns. You're taking significantly more risk than you think.

Action steps:

Review your allocation: If your portfolio has drifted heavily toward equities during the bull market, higher bond yields now offer an attractive rebalancing opportunity

Focus on income, not just duration: Traditional bond indexes like the U.S. Agg predominantly hold Treasuries and investment-grade credit, missing higher-yielding opportunities in areas like European high yield, securitized assets, and floating-rate instruments

Consider shorter maturities: With the yield curve normalizing, the front end of the curve offers attractive carry without excessive interest rate risk

The Debt Decision: When to Pay Down vs. Invest

High rates create a crucial calculation: should you aggressively pay down debt, or invest and let compound interest work for you?

The Math Has Changed

When mortgages were 3% and investment returns averaged 10%, the answer was obvious: invest. When mortgages hover near 7% and future equity returns are less certain, it's more nuanced.

Refinancing realities:

The national average 30-year fixed refinance rate stands at 6.61% as of December 2025

70% of homeowners with mortgages have loans below 5%, making refinancing financially unattractive for most

Many are turning to home equity lines of credit (HELOCs) instead, which are tied to the prime rate and could benefit from future rate cuts

Strategic debt management:

High-interest debt first: Credit card rates averaging 20%+ make this debt mathematically toxic—prioritize elimination

Mortgage debt: If your rate is below 5%, focus on investing rather than prepayment; if above 7%, consider accelerated paydown

Consider opportunity cost: A diversified, income-oriented fixed income portfolio has markedly outperformed the U.S. Agg since the pandemic with nearly half the volatility

The HELOC Strategy

If you locked in a sub-4% mortgage but need access to cash:

HELOCs preserve your low rate: Unlike cash-out refinancing, a HELOC lets you access equity without replacing your entire mortgage

Variable rate risk: HELOC rates fluctuate with the prime rate—beneficial if the Fed continues cutting, problematic if rates rise

Use strategically: Best for defined purposes like home improvements or high-interest debt consolidation, not ongoing lifestyle funding

Portfolio Construction in the New Era

The 60/40 portfolio isn't dead—but it needs recalibration for a world where both stocks and bonds can deliver meaningful returns.

Rethinking Asset Allocation

Traditional approach problems:

Many portfolios are inadvertently overweight equities after years of stock market gains

Cash positions earning 5%+ create new opportunity costs

The risk-return trade-off has shifted significantly

Modern allocation principles:

Diversify beyond U.S. large caps: The Magnificent 7 stocks declined 8.4% year-to-date in 2025 after contributing 60% and 54% of S&P 500 returns in 2023-2024

Embrace global fixed income: A diversified, income-oriented portfolio using the full global fixed income universe has outperformed the U.S. Agg every year since the pandemic

Consider alternatives: With potential for elevated stock-bond correlations if inflation resurges, diversifying alternatives with low correlations to both become critical

Don't abandon equities: A balanced 60/40 portfolio still has an estimated 10-year return of 6.3% annually, according to PGIM projections

The Cash Trap

Yes, money market funds and high-yield savings accounts finally pay decent rates. But parking too much there creates hidden costs:

Opportunity cost: While 5% feels good, it barely outpaces inflation and significantly trails diversified portfolio returns

Behavioral risk: Cash feels safe, but sitting in cash during market recoveries has historically cost investors dearly

The reset risk: As the Fed cuts rates, money market and savings rates will decline in tandem

Recommended cash levels:

Emergency fund: 3-6 months expenses

Near-term goals (< 2 years): Keep in cash equivalents

Everything else: Invest according to your risk tolerance and time horizon

Making It Systematic: The Surmount Advantage

Here's where most investors fail: they know what they should do but don't actually do it. They know they should rebalance when portfolios drift. They know they should dollar-cost average during volatility. They know they shouldn't panic sell.

But knowing isn't doing.

DALBAR's research consistently shows the average investor underperforms market indexes by significant margins—not because they pick bad investments, but because they make emotional decisions at precisely the wrong times.

The systematic solution:

Modern platforms like Surmount let you:

Codify your strategy in advance: Build rules-based approaches that execute regardless of market sentiment

Automate rebalancing: Systematically buy low and sell high without emotion override

Implement income strategies: Capture bond yields and dividend income systematically

Adapt to rate changes: Adjust fixed income duration and credit exposure as conditions evolve

You're not trusting future-you to make rational decisions during the next Fed meeting or market panic. You're building a system that operates optimally whether rates are rising, falling, or staying put.

Action Plan: What to Do Right Now

1. Audit your current allocation:

Calculate your actual stock/bond/cash split

Compare to your target allocation

Identify how far you've drifted

2. Optimize your fixed income:

Move excess cash into short-duration bonds or bond funds

Consider diversifying beyond Treasury-heavy indexes

Evaluate whether your bond allocation matches your risk tolerance

3. Address high-interest debt:

Prioritize credit card and personal loan paydown

Evaluate whether mortgage refinancing makes sense (generally only if you can drop rates by 75+ basis points)

Consider HELOCs for accessing equity while preserving low mortgage rates

4. Systematize your approach:

Set up automatic rebalancing triggers

Implement dollar-cost averaging for new investments

Create rules-based criteria for when to adjust allocations

5. Resist the cash trap:

Keep appropriate emergency reserves

Invest the rest according to your timeline

Remember that "feeling safe" in cash often costs you real returns

The Bottom Line

Higher interest rates aren't a problem to solve—they're a new reality to navigate. After more than a decade of financial repression where savers earned nothing and borrowers paid almost nothing, we're back to a more historically normal regime.

This creates winners and losers:

Winners: Disciplined savers, strategic bond investors, those who automate emotion out of decision-making

Losers: Those paralyzed by nostalgia for 3% mortgages, those keeping excessive cash because it "finally pays something," those making tactical bets on Fed policy

The key insight? You can't control interest rates. You can't predict the Fed's next move with certainty. But you can control your allocation, your debt strategy, and whether you let discipline or emotion drive your decisions.

In a high-rate world, the premium on systematic, unemotional execution has never been higher. The investors who thrive won't be those who perfectly time rate cycles. They'll be those who build robust, diversified portfolios and stick to them regardless of what Jerome Powell says next week.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.