Education

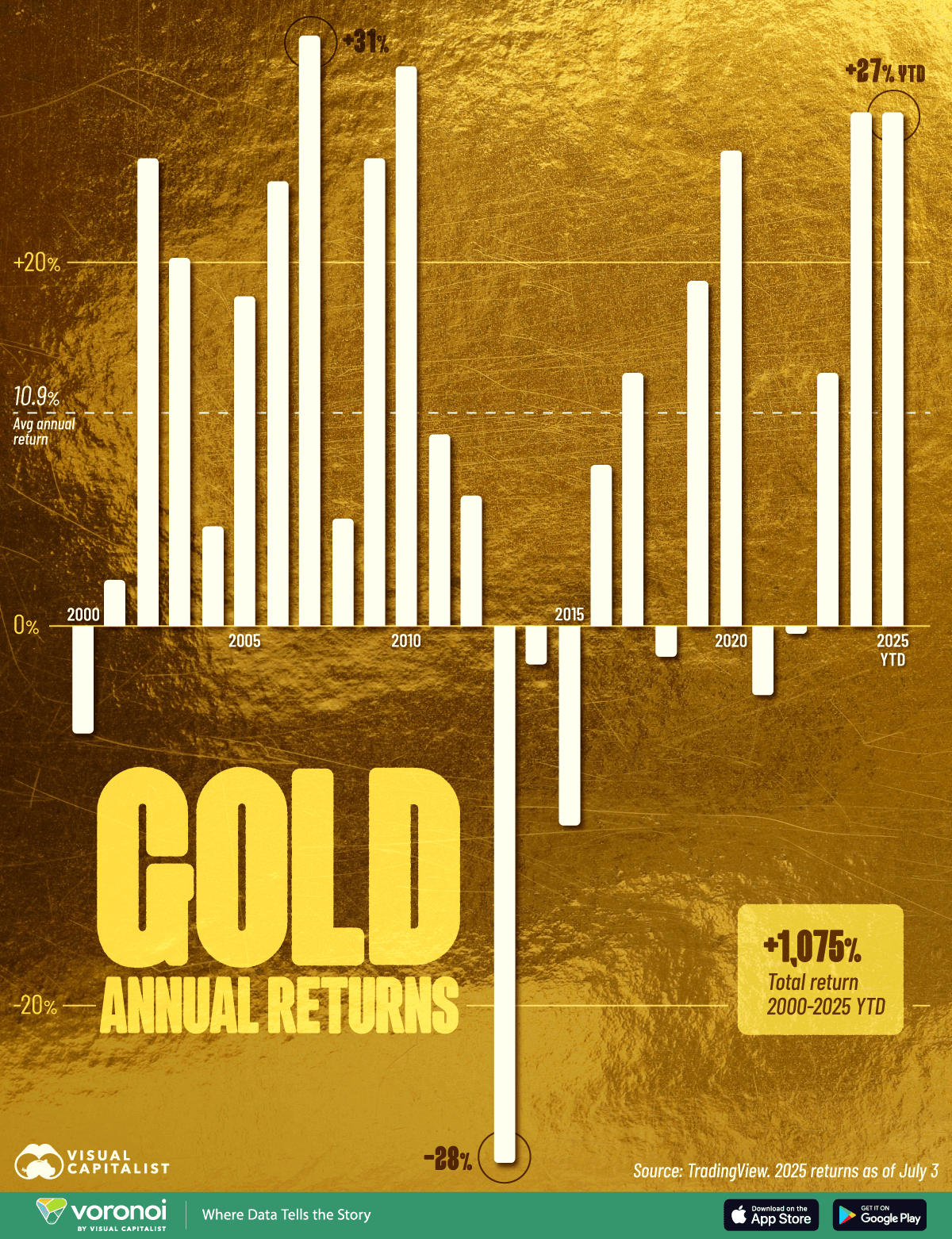

With gold breaking past $4,400 per ounce and silver touching historic levels above $69 this week, precious metals are delivering their strongest performance since 1979. The question isn't whether these assets are moving — it's whether you should be moving with them.

The Rally That Changed Everything

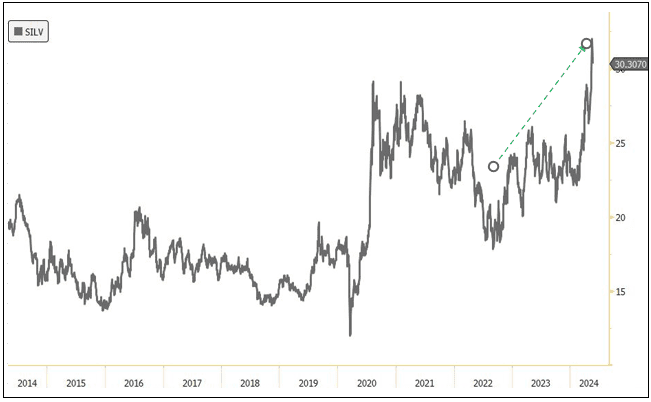

The numbers are striking. Gold has surged approximately 70% in 2025, while silver has outpaced even that trajectory with gains exceeding 130% year-to-date. For context, gold last delivered annual returns this strong during the inflationary crisis of the late 1970s.

What's driving this? Three structural forces have converged:

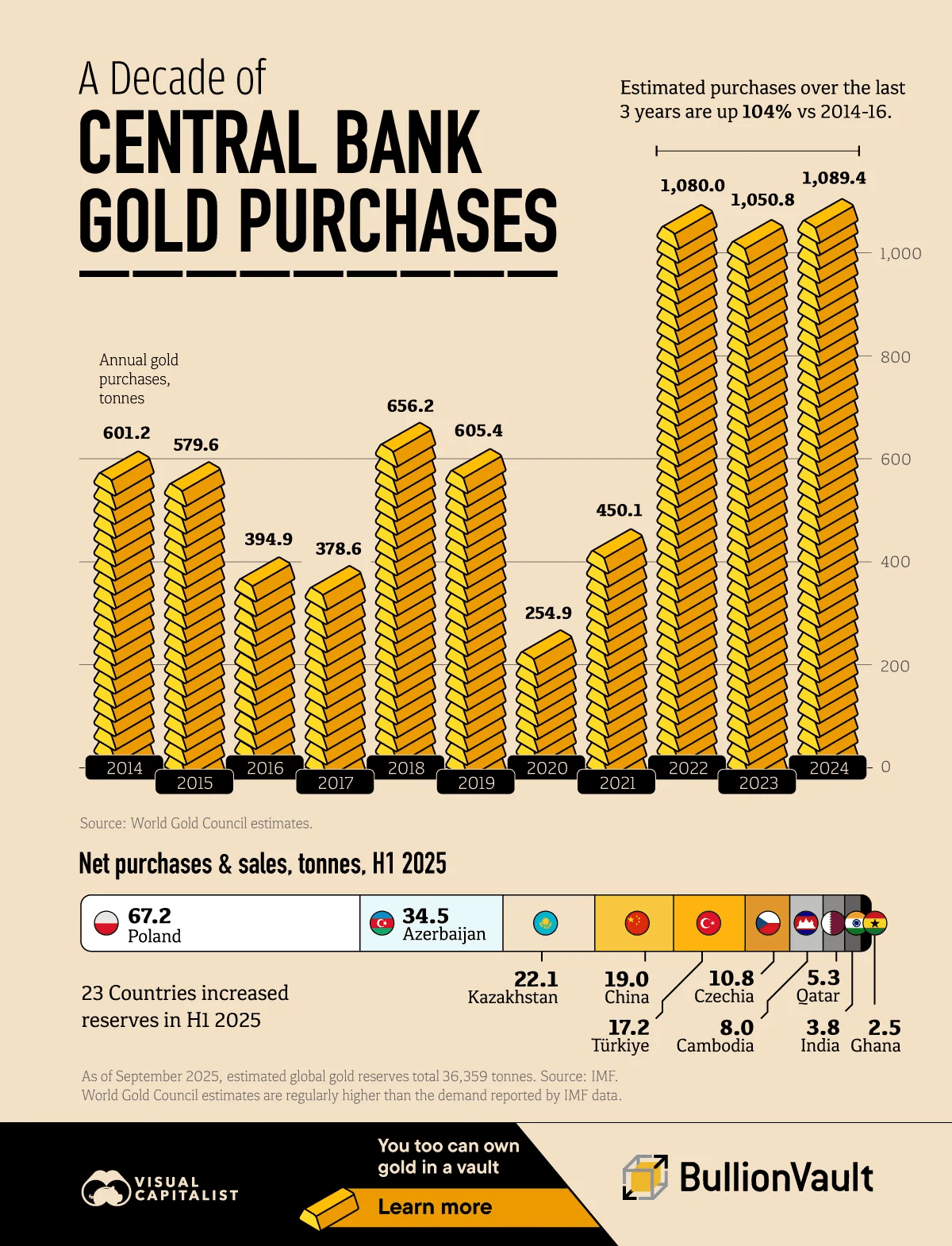

Central bank buying at unprecedented levels — Official institutions purchased over 1,000 tonnes of gold annually from 2022 through 2024, representing the highest sustained accumulation since records began in 1950

Dollar depreciation — The U.S. Dollar Index has declined roughly 10% in 2025, marking its steepest drop in decades as global reserve managers diversify away from dollar-denominated assets

Monetary easing — The Federal Reserve's interest rate cuts have reduced the opportunity cost of holding non-yielding assets like gold, with futures markets pricing in additional cuts through 2026

Silver's Industrial Advantage

While gold captures headlines as a monetary asset, silver's dual identity as both precious metal and industrial commodity creates unique demand dynamics. Industrial applications now account for roughly 59% of silver demand, with three sectors driving structural growth:

Solar photovoltaics: The solar industry consumed approximately 230 million ounces in 2024, representing nearly 29% of total industrial demand. Advanced solar cell technologies like TOPCon require up to 50% more silver than traditional panels, offsetting efficiency gains.

Electric vehicles: Battery-electric vehicles use 25-50 grams of silver per unit — roughly double the amount in internal combustion vehicles. With global EV sales projected to exceed 17 million units annually, automotive silver demand is forecast to grow 3.4% annually through 2031.

Data centers: The AI revolution demands massive computing infrastructure. Global IT power capacity has increased 53-fold since 2000, with silver's superior conductivity making it essential for high-performance servers and electrical connections.

The supply picture intensifies this narrative. The silver market has operated in structural deficit for five consecutive years, with mine production unable to keep pace with industrial and investment demand.

The Central Bank Signal

Perhaps no indicator matters more than institutional behavior. Central bank gold holdings now constitute nearly 20% of official reserves, up from approximately 15% at the end of 2023. This represents the highest concentration since the Bretton Woods era.

Poland, India, and Turkey have led recent accumulation, but the trend extends across emerging markets seeking to reduce dollar dependency. In the first half of 2025 alone, 23 countries increased their gold reserves, with Poland adding 67 tonnes and maintaining its position as Europe's most aggressive buyer.

The motivation? Geopolitical diversification away from dollar-denominated assets, concerns about U.S. fiscal trajectory, and the neutral status of gold as a reserve asset that transcends political systems.

Understanding the Risks

Precious metals aren't one-way trades. Gold's realized volatility increased in 2025, though it remains broadly in line with long-term averages. Silver, however, demonstrates significantly higher volatility — a function of its smaller market size and dual role as industrial commodity.

Consider these headwinds:

Valuation concerns: After 70% gains, gold trades well above most analysts' historical valuation models. Some forecasters project pullbacks to $3,500 by late 2026, suggesting room for meaningful corrections.

Interest rate sensitivity: If inflation proves stickier than expected and the Fed reverses course toward higher rates, gold's opportunity cost increases. Real yields — inflation-adjusted returns on Treasuries — remain one of gold's strongest inverse correlations.

Industrial demand shocks: Silver's reliance on solar, EV, and electronics sectors creates vulnerability to economic slowdowns or policy shifts that could dampen clean energy investment.

Currency dynamics: A strengthening dollar would typically pressure precious metals, though this relationship has proven less reliable during the current cycle as structural de-dollarization trends persist.

The Case for Strategic Allocation

Major institutions are projecting further upside. J.P. Morgan forecasts gold reaching $5,055 per ounce by Q4 2026, while Goldman Sachs targets $4,900 by December 2026. These aren't speculative price calls — they're based on structural demand from central banks and ETF investors that shows no signs of exhaustion.

For individual investors, portfolio allocation depends on objectives and risk tolerance. Conservative frameworks suggest:

5-10% total precious metals exposure for balanced portfolios seeking downside protection

Gold-to-silver ratio of 70-80% reflecting gold's lower volatility and liquidity advantages

Dollar-cost averaging rather than attempting to time entry points, particularly given current elevated prices

The historical evidence supports diversification benefits. During equity market selloffs — including 2008, 2020, and various emerging market crises — gold has delivered positive or neutral returns while stocks declined sharply.

The Investment Framework

Precious metals aren't about timing peaks. They're about portfolio insurance against scenarios your other assets can't handle: currency debasement, geopolitical instability, loss of confidence in monetary authorities.

Right now, those scenarios look increasingly plausible. The U.S. federal budget deficit runs at 7% of GDP while most developed economies maintain similarly expansive fiscal positions. Central banks are cutting rates despite persistent inflation. Geopolitical fragmentation shows no signs of reversing.

This is the environment where systematic, automated investment strategies become essential. Platforms that allow you to build data-driven portfolios — rebalancing based on volatility, correlation, and momentum signals rather than emotional reactions — can capture precious metals' defensive characteristics without requiring constant attention.

The question isn't whether gold and silver are expensive. It's whether your portfolio is prepared for the structural forces reshaping global finance. Sometimes the most rational move is to hold assets that seem fully valued precisely because everyone else is finally recognizing their value.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.