Education

Interest rate decisions from the Federal Reserve ripple through every corner of your portfolio—from the bonds you hold to the dividend stocks generating income to the cash sitting in money markets. As we navigate 2026 with the Fed having cut rates three times in 2025, bringing the federal funds rate to 3.50-3.75%, understanding how to position your portfolio for the evolving rate environment has never been more important.

The path ahead remains uncertain. Markets assign only 16% probability to a January 2026 cut, rising to 45% by April, with Fed officials signaling a cautious approach. For investors, this creates both challenges and opportunities—particularly for those who leverage automated strategies to adjust allocations as rate conditions shift.

The 2026 Rate Environment: What the Data Shows

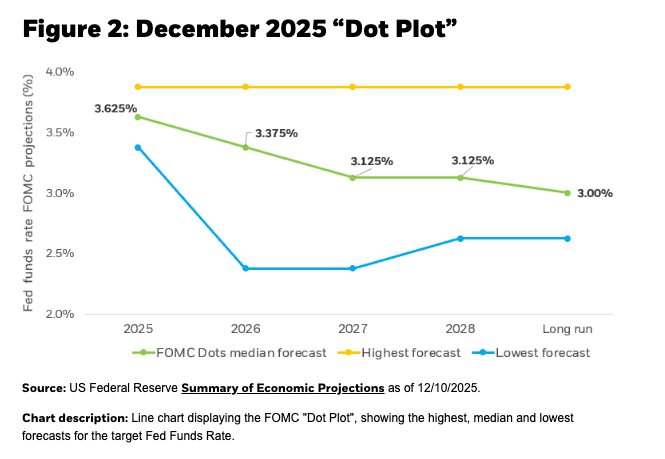

Following an aggressive easing cycle that began in September 2024, the Federal Reserve now finds itself in what economists call a "data-dependent pause." The December 2025 Summary of Economic Projections indicated consensus for just one additional 25 basis point cut in 2026, though market expectations diverge significantly from Fed guidance.

Key factors shaping the rate outlook:

Labor market showing signs of cooling, with unemployment concerns mounting among some Fed members

Inflation remains above the 2% target, complicating the dual mandate

Jerome Powell's term expires May 15, 2026, introducing leadership uncertainty

New Fed chair expected to favor lower rates, though committee composition limits immediate influence

Charles Schwab expects the Fed to cut to somewhere in the 3.0-3.5% range over 2026, implying two to three additional cuts. Meanwhile, Morningstar senior economist Preston Caldwell forecasts two cuts in 2026, followed by three more in 2027—a more dovish trajectory than Fed projections suggest.

The divergence between Fed guidance and market expectations creates exactly the kind of environment where systematic, rules-based portfolio management delivers value.

Why Fixed Income Deserves Fresh Attention

After years of near-zero yields that made bonds unattractive, the fixed income landscape has fundamentally changed. Treasury yields, while down from their 2023 peaks, remain elevated by historical standards. LPL Research forecasts 10-year Treasury yields rangebound between 3.75-4.25% in 2026, creating an environment where bond income can actually outpace inflation.

The fixed income opportunity in 2026:

Positive real interest rates (yields adjusted for inflation) for the first time in years

Bond returns primarily from coupon income rather than price appreciation

Agency MBS and investment-grade corporates expected to outperform Treasuries given higher starting yields

Tax advantages of municipal bonds particularly attractive for high-bracket investors

The key challenge? Timing your bond purchases to capture yields before additional cuts push rates lower. Fidelity notes that even as the Fed cuts short-term rates, longer-maturity bond yields may remain relatively stable, influenced by factors beyond Fed policy—inflation expectations, fiscal deficits, and global capital flows.

Automated Bond Ladders: Capturing Yield While Managing Risk

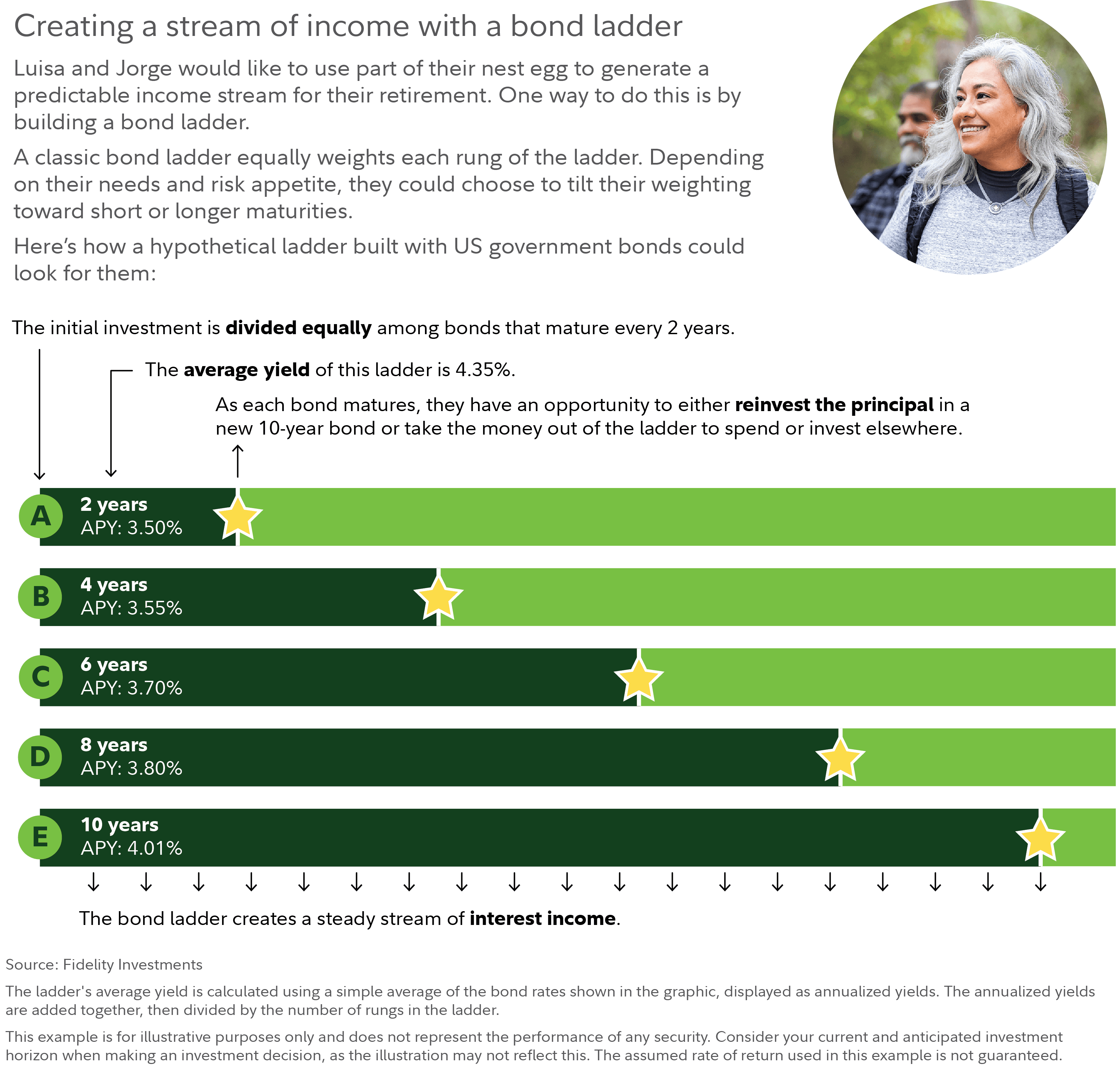

For investors looking to position in fixed income, bond laddering offers a systematic approach that removes the need to predict rate movements. A bond ladder spreads investments across securities with staggered maturity dates—perhaps bonds maturing every year for the next five years.

Why laddering works in uncertain rate environments:

If rates rise, maturing bonds can be reinvested at higher yields

If rates fall, you still hold higher-yielding bonds purchased earlier

Creates predictable income streams as bonds mature on schedule

Treasury bonds offer state and local tax exemptions, boosting after-tax yields

The execution challenge has traditionally been research-intensive and complex. Wealthfront's Automated Bond Ladder pioneered automating this strategy, analyzing hundreds of Treasury securities to build optimized ladders from 3 months to 6 years. The platform handles reinvestment as bonds mature, eliminating the manual tracking that makes DIY laddering cumbersome.

Schwab's bond ladder research emphasizes focusing on higher-rated bonds to ensure capital preservation and reliable income. For most investors, this means Treasuries and investment-grade corporates rather than high-yield bonds where default risk could disrupt the ladder's income consistency.

Dividend Stocks and REITs: The Rate-Cut Beneficiaries

While bonds capture attention during rate cycles, dividend-paying stocks—particularly utilities and Real Estate Investment Trusts (REITs)—often emerge as major beneficiaries when the Fed eases policy. The mechanics are straightforward: lower rates reduce borrowing costs for capital-intensive businesses while making dividend yields relatively more attractive compared to fixed income.

Historical performance data tells a compelling story:

For nearly five decades, US REITs delivered 9.48% annualized returns in the 12 months following Fed easing cycles, compared to 7.57% for US stocks

Data center, telecom infrastructure, and healthcare REITs historically benefit most from lower rates

US REITs positioned for potential 17% return in 2026 as rate cuts and discounted valuations converge

Analysis from early 2026 shows the structural shift in dividend stock dynamics. Lower rates create a dual benefit: pure yield-seeking behavior as bond yields fall makes dividend stocks relatively more appealing, while simultaneously improving fundamentals for debt-heavy sectors like utilities and REITs as interest expenses decline.

Top dividend considerations for 2026:

Realty Income (O): 5.72% yield with 30+ years of consecutive dividend increases

NextEra Energy (NEE): Utility with 10% dividend growth target through 2026

Prologis (PLD): Industrial logistics REIT with 3.16% yield and "Strong Buy" consensus

Digital Realty Trust (DLR): Data center REIT with 3.3% yield benefiting from AI infrastructure demand

The challenge? These sectors can experience significant volatility during rate transitions. Realty Income, despite its reputation for stability, gained only 8% in 2025 as profit challenges offset the rate-cut benefits. Timing individual moves into these sectors requires either conviction about rate path or systematic approaches that adjust allocations as conditions evolve.

Automated Portfolio Adjustment: Beyond Buy-and-Hold

Traditional portfolio management operates on calendar intervals—quarterly reviews, annual rebalancing—creating inherent lags between rate environment shifts and portfolio positioning. When the Fed pivots toward easing, investors following manual approaches may miss optimal entry points in rate-sensitive sectors or fail to reduce exposure to assets that underperform in lower-rate environments.

Automated portfolio strategies can dynamically adjust allocations based on rate conditions:

Rate-responsive positioning includes:

Increasing fixed income duration as rates decline to capture price appreciation

Rotating into REITs and dividend stocks when easing cycle begins

Systematically harvesting gains from rate-sensitive positions that have appreciated

Adjusting cash allocations as money market yields compress

LPL Research notes that as Fed cuts continue, cash yields will decline, allowing high-quality bonds to outperform cash holdings. An automated approach can systematically redeploy cash into bonds or dividend equities as this yield differential shifts, capturing the opportunity without requiring manual intervention.

The tax implications add another layer of complexity. Lower rates often coincide with capital gains opportunities as bond prices appreciate. Systematic tax-loss harvesting—discussed in our portfolio rebalancing article—becomes even more valuable when combined with rate-aware positioning, offsetting gains from rate-sensitive trades with strategic loss realization elsewhere in the portfolio.

Implementation With Surmount: Rate-Aware Automation

For investors seeking to implement sophisticated rate-responsive strategies without constant monitoring, Surmount provides the infrastructure to automate these adjustments based on your specified parameters and market conditions.

How Surmount enables rate-aware investing:

No-Code Strategy Creation: Build multi-asset strategies that systematically adjust bond/equity allocations based on rate environment indicators without writing code

Automated Bond Integration: Incorporate Treasury positions and laddering logic directly into broader portfolio strategies, rebalancing as yields shift

Dividend Stock Rotation: Set rules to increase REIT and utility exposure when Fed signals easing, automatically implementing the rotation as conditions trigger

Tax-Optimized Execution: Intelligent trading that considers tax implications of rate-driven allocation shifts, harvesting losses to offset gains from appreciating bond positions

Continuous Monitoring: 24/7 evaluation of rate indicators and portfolio positioning, executing adjustments when your thresholds are met rather than waiting for quarterly reviews

The platform handles the mechanical complexity—tracking Fed communications, monitoring yield curves, calculating optimal allocations, executing trades tax-efficiently—while you maintain complete control over strategy parameters and risk tolerance.

Example implementation: A rate-aware balanced strategy might specify: "If 10-year Treasury yields fall below 4%, increase total bond allocation from 40% to 50%, sourcing capital from large-cap equities. If Fed funds rate drops below 3.25%, add 5% allocation to diversified REIT index. Rebalance monthly and harvest tax losses opportunistically."

Surmount executes this logic automatically, monitoring conditions daily and implementing changes when triggers activate. You receive notifications of adjustments and maintain full visibility into the rationale for each trade.

Positioning for the Path Ahead

As 2026 unfolds with continued Fed uncertainty and potential leadership changes, the investors best positioned are those with systematic frameworks for adjusting to evolving conditions rather than static allocations built for a different rate environment.

Key principles for rate-aware investing:

Lock in current yields through laddered Treasury positions before additional cuts

Build exposure to quality dividend stocks and REITs that benefit from lower rates

Use systematic approaches to adjust allocations as Fed policy and market conditions shift

Maintain tax awareness as rate changes create capital appreciation opportunities

Avoid trying to perfectly time rate moves—implement rules-based frameworks instead

The explosive growth in automated portfolio management—with global robo-advisor AUM reaching $2.06 trillion in 2025—reflects widespread recognition that algorithmic approaches often outperform manual timing attempts, particularly in complex environments like shifting rate regimes.

Ready to automate your rate-responsive strategy? Explore Surmount and discover how to build sophisticated multi-asset approaches that dynamically adjust to interest rate environments, capturing opportunities in bonds, dividend stocks, and REITs while managing risk systematically.

The question isn't whether rates will fall further in 2026—it's whether your portfolio positioning adapts as conditions evolve or remains locked into assumptions from a different rate environment. With the right automated framework, you can ensure your allocations shift intelligently as the Fed's path becomes clearer.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.