Education

After three years of tech and AI dominance, dividend stocks are staging a quiet comeback. While mega-cap growth names grabbed headlines in 2025, the conditions brewing for 2026 suggest dividend-paying companies could finally reclaim the spotlight—and outperform.

With valuations looking "frothy" in tech, interest rates continuing to decline, and market breadth expanding beyond the Magnificent Seven, dividend stocks offer something growth investors forgot about: predictable returns backed by cash flow, not promises.

Tech's Dominance Left Dividends Behind in 2025

The numbers tell the story. Through most of 2025, dividend strategies lagged the broader market by several percentage points as AI and technology stocks drove nearly all gains.

Why dividend stocks underperformed:

Tech sector represented over one-third of the broad market but only 18% of dividend growth strategies

The Magnificent Seven (Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, Tesla) don't pay meaningful dividends relative to their valuations

Investors chased capital appreciation over income as growth momentum persisted

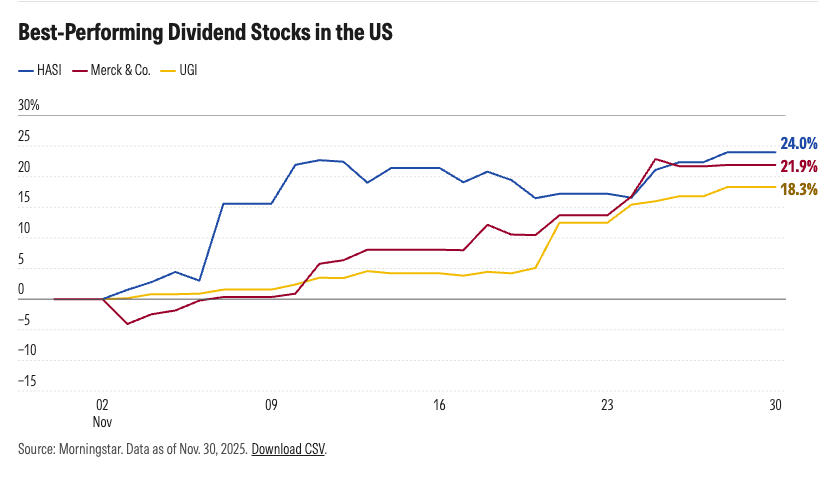

But late 2025 showed signs of rotation. The Morningstar Dividend Leaders Index outperformed the broader market mid-year, climbing 6.5% versus 3.0% for the general market index through June. High-yielding sectors like utilities and financials finally delivered after years of underperformance.

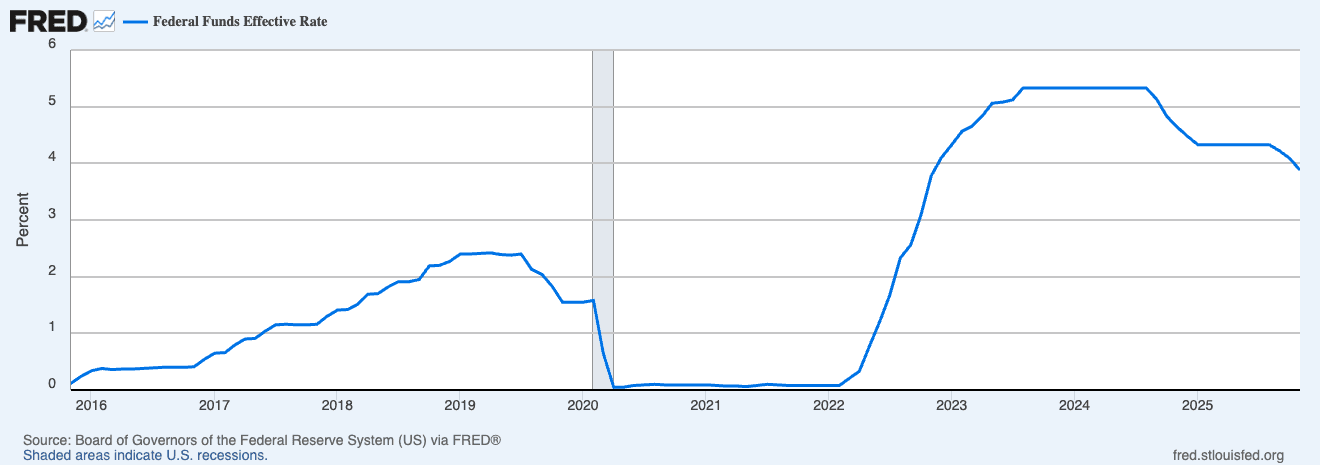

Lower Interest Rates Change the Equation

The Federal Reserve cut rates three times in 2025, bringing the federal funds rate to 3.50%-3.75%. The Fed projects GDP growth accelerating to 2.3% in 2026 from 1.7% in 2025—creating a goldilocks scenario for dividend stocks.

Why lower rates benefit dividend payers:

Yield competition shrinks: High-yield savings accounts dropping from 5%+ to low-4% range makes dividend yields relatively more attractive

Borrowing costs decline: Companies with higher debt loads (utilities, REITs) see direct benefit from reduced interest expenses

Valuation support: Lower discount rates increase present value of future dividend streams

Capital rotation: As bond yields compress, income-seeking investors pivot to equities

This isn't theoretical. International dividend stocks delivered 35% returns year-to-date in 2025 as falling dollar and lower central bank rates created tailwinds. The same dynamic is setting up for U.S. dividend payers heading into 2026.

Valuations Favor Dividend Stocks Over Growth

Morningstar analysts think the U.S. equity market looks "frothy" overall, with AI-related tech valuations particularly "rich." Meanwhile, valuations appear "a lot more reasonable on the value side of the market, which is where a lot of dividend-paying stocks tend to be."

Current valuation snapshot:

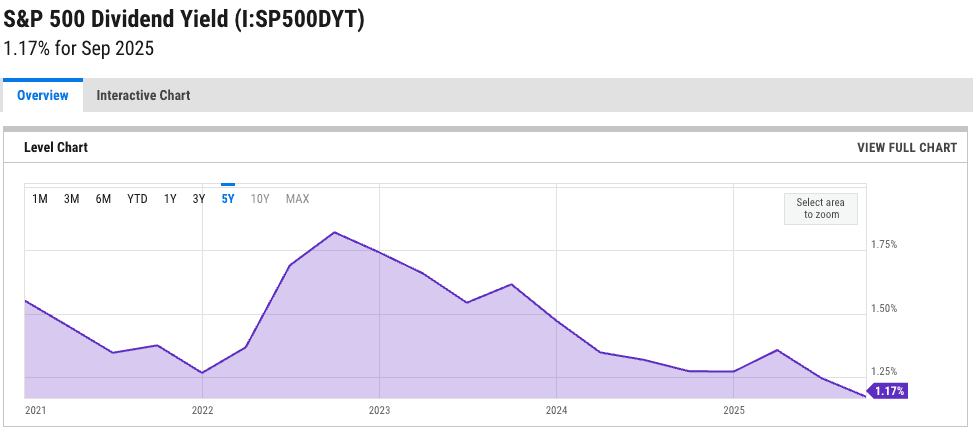

S&P 500 dividend yield: approximately 1.15%

Many quality dividend payers trading at 10-year lows relative to growth stocks

Dividend stocks offer downside protection that stretched tech valuations don't

Consider the contrast: Tech giants trade at premium multiples justified by AI growth projections that 95% of organizations haven't monetized. Dividend aristocrats trade at reasonable valuations backed by decades of cash generation and consistent payout growth.

Sector Winners for 2026

Not all dividend stocks are created equal. Certain sectors are particularly well-positioned for the 2026 environment.

Financials: Banks like JPMorgan and Bank of America had strong 2025 performance. Higher-for-longer interest rates through mid-2025 supported net interest margins, while deregulation provided tailwinds. As rates stabilize, banks with strong deposit franchises maintain profitability.

Utilities: The AI infrastructure boom creates massive power demand. Data centers running ChatGPT and other AI models consume electricity "on the scale of small cities." Utilities with exposure to data center growth offer 4-6% yields plus growth.

Consumer Staples: Companies like Coca-Cola (2.79% yield) and Procter & Gamble offer stability with 50+ year dividend growth streaks. Brand power and pricing ability protect against inflation.

Healthcare: Merck rallied 25% from mid-2025 lows, offering 3.36% yield with 14-year dividend growth streak. Pharmaceutical giants combining innovation pipelines with reliable payouts look attractive.

Tech Is Finally Joining the Dividend Party

The dividend landscape is evolving. Meta, Alphabet, and Salesforce announced their first-ever dividends in recent years. Tech stocks have grown from 2.3% of dividend growth indexes in 2003 to 18% by 2023.

What this means for investors:

Dividend strategies gain exposure to companies "that have driven the market more recently"

Microsoft leads dividend growth indexes at significant weight

Tech dividend yields remain low but growth potential is substantial

Qualcomm marked its 23rd consecutive year of dividend growth in 2025

This creates interesting opportunities. Investors no longer must choose between growth and income—select tech names now offer both, combining innovation with shareholder returns.

The Systematic Advantage for Dividend Investing

Dividend stocks excel in systematic, rules-based strategies for several reasons:

Objective screening: Algorithms can efficiently identify companies with:

Consecutive years of dividend growth (Dividend Aristocrats, Dividend Kings)

Payout ratios under 75% ensuring sustainability

Free cash flow coverage exceeding dividends

Balance sheet strength to weather downturns

Disciplined rebalancing: Systematic approaches capture:

Sector rotations as dividend leaders shift

Valuation opportunities when quality names sell off

Dividend growth inflection points

Risk management: Dividend-focused systematic strategies naturally:

Reduce concentration in overvalued growth stocks

Tilt toward profitable, cash-generative businesses

Provide downside protection through income component

Platforms like Surmount allow investors to build customized dividend strategies—whether focused on high yield, dividend growth, or quality screens—and execute them systematically without emotional interference.

What Could Go Wrong

Honesty requires acknowledging risks:

Recession scenario: Economic downturn could pressure dividends as companies cut payouts to preserve cash. However, quality dividend payers typically maintain dividends through recessions.

Persistent inflation: If inflation stays elevated above 3%, the Fed may delay rate cuts, keeping bond yields competitive with dividend yields.

Tech resurgence: If AI monetization finally materializes, growth stocks could extend their leadership.

Sector concentration: Many dividend strategies overweight financials, utilities, and consumer staples—sectors that struggled during 2023-2024's tech rally.

The counterargument: These risks exist regardless. Dividend stocks provide tangible cash flow and downside protection that speculative growth names don't offer when markets correct.

Building a 2026 Dividend Strategy

For investors considering dividend allocation heading into 2026, several approaches merit attention:

Dividend growth focus: Target companies with 10+ year dividend growth streaks, moderate yields (2-4%), and strong balance sheets. Think Microsoft, Visa, JPMorgan.

High-yield approach: Accept more risk for yields above 5%. Mortgage REITs yielding 12-15% and energy infrastructure MLPs offer substantial income but require stronger conviction.

Quality screens: Combine dividend yield with economic moat ratings and financial strength metrics to avoid dividend traps.

International diversification: International dividend ETFs delivered 35% in 2025. With only 3% tech allocation versus 33% for U.S. markets, they offer natural diversification.

The 2026 Setup

Multiple forces are converging to create conditions dividend stocks haven't seen in years:

Lower interest rates reducing yield competition

Tech valuations stretched after three-year rally

Market breadth expanding beyond mega-caps

Corporate balance sheets strong with rising free cash flow

Fed projects 2.3% GDP growth—goldilocks for dividends

The investors who thrive in 2026 won't necessarily be those predicting the next market move. They'll be those with strategies flexible enough to capture value wherever it appears—and disciplined enough to allocate toward quality cash flows rather than speculative narratives.

That's precisely where dividend stocks shine. Not because they're exciting. Because they're reliable, systematically identifiable, and increasingly attractive as growth stocks revert from extremes.

2026 could be the year investors remember why dividends matter.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.