Education

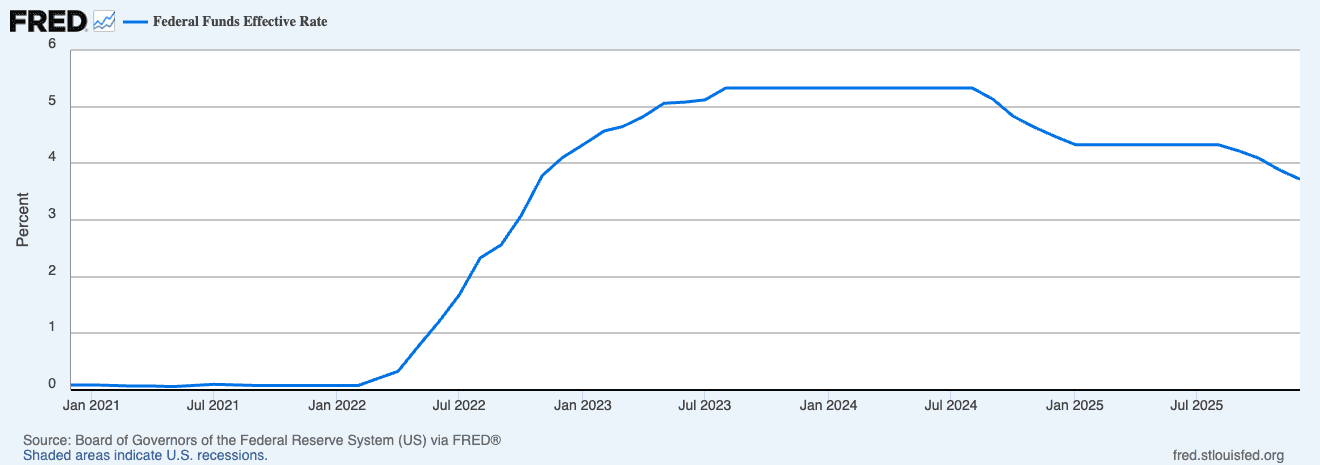

The decade-long era of rock-bottom interest rates is over. After the Federal Reserve cut rates to 3.5%-3.75% in December 2025, borrowing costs remain substantially higher than the near-zero rates investors grew accustomed to between 2008 and 2021.

While lower than the 5.5% peak in 2023, these elevated rates represent a fundamental shift—one that demands a different approach to building wealth. The good news? Higher rates have created opportunities that simply didn't exist during the zero-interest-rate era.

Why Rates Remain Elevated

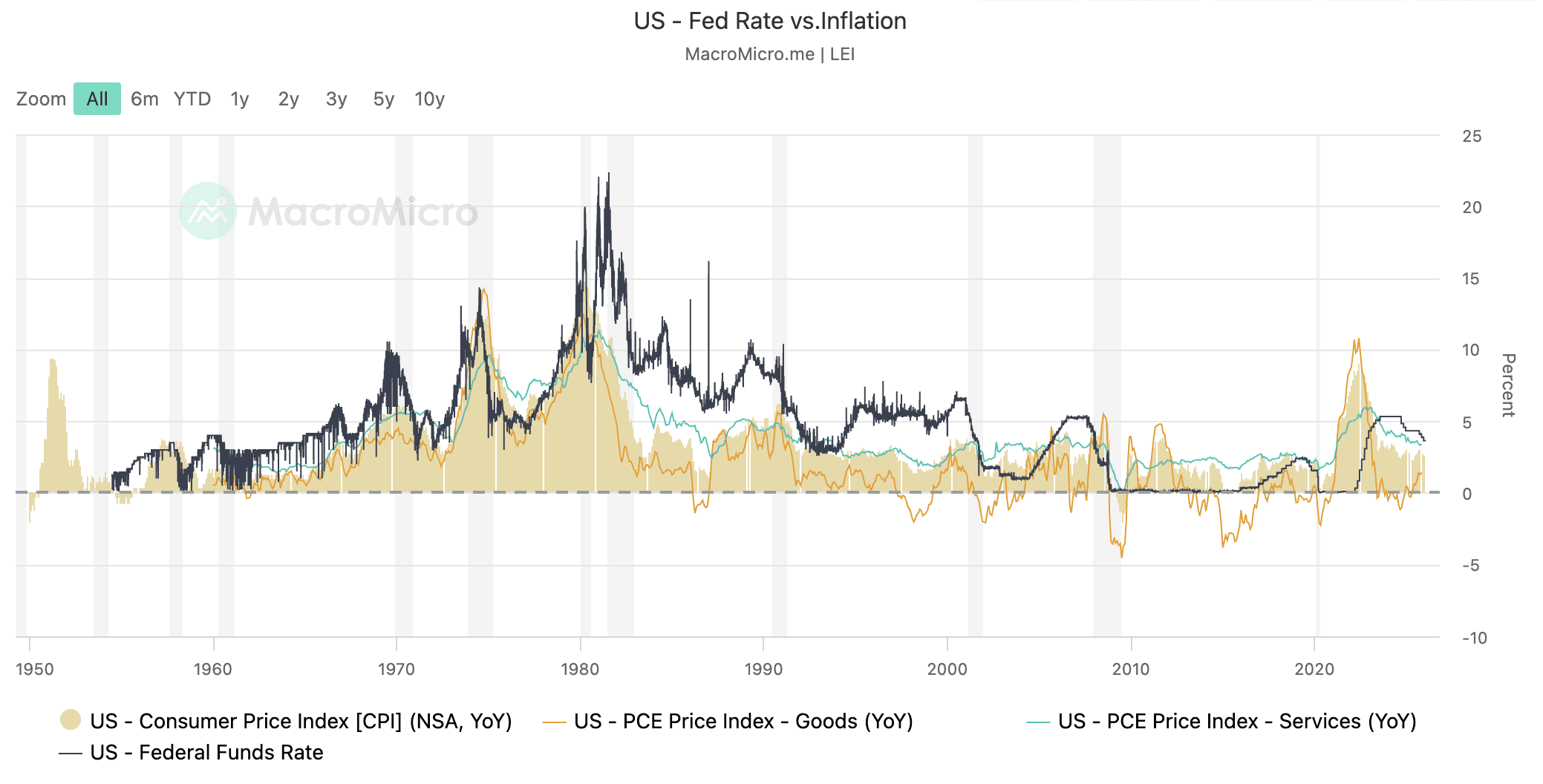

Despite three consecutive rate cuts totaling 1.75 percentage points since September 2024, inflation remains stubbornly above the Fed's 2% target. Key factors keeping rates elevated include:

Persistent inflation: CPI running at 2.7% year-over-year as of December 2025

Tariff pressures: Core goods prices experiencing upward pressure from trade policy

Strong economic growth: Q3 2025 GDP grew at 4.3% annually, suggesting rates aren't constraining activity

Limited future cuts: The Fed projects only one additional 25 basis point cut in 2026

This measured approach reflects genuine uncertainty about structural forces—fiscal deficits, shifting trade dynamics, and AI-driven capital spending—that may be resetting baseline assumptions about neutral rates.

The Silver Lining: Real Returns Are Back

For the first time in over a decade, savers can earn meaningful risk-free returns that actually outpace inflation:

Inflation at 2.7% vs. savings accounts paying 4%+ APY

Positive real returns without equity or credit risk

No forced march onto the risk spectrum just to keep pace with inflation

Between 2010 and 2021, this simply wasn't possible. Today, the calculus has fundamentally changed.

Treasury Bills: Government-Backed Simplicity

Current T-bill yields hover around 4%, offering returns that are:

Tax-advantaged: Exempt from state and local taxes

Highly liquid: Maturities from four weeks to 52 weeks

Government-backed: Full faith and credit of the U.S. Treasury

Rate-locked: Unlike savings accounts, your return is guaranteed at purchase

For tactical cash management, T-bills offer an elegant solution. Access them through TreasuryDirect or integrate seamlessly through brokerage accounts for broader portfolio coordination.

High-Yield Savings: Flexibility Meets Returns

High-yield savings accounts continue offering rates in the 4% range, with the added benefit of complete liquidity. Leading platforms provide:

FDIC insurance up to $2 million through sweep programs

No minimum balances or monthly fees

Instant access to funds when needed

8x the national average for traditional checking accounts

Platforms like Wealthfront, Betterment, and Marcus by Goldman Sachs make it straightforward to earn meaningful returns on emergency funds and short-term savings.

GICs for Canadian Savers

Canadian investors have similar opportunities through Guaranteed Investment Certificates. The highest 5-year GIC rates currently sit around 4%, with:

Principal and interest guaranteed

CDIC insurance up to $100,000 per account category

Flexible terms from six months to five years

Competitive rates from institutions like First Ontario and EQ Bank

Strategic considerations center on term length. Shorter terms (1-2 years) provide flexibility if rates rise, while longer terms lock in current yields against future rate cuts. Many Canadian institutions offer 3-year GICs in the 3.8% range—compelling for conservative portfolios.

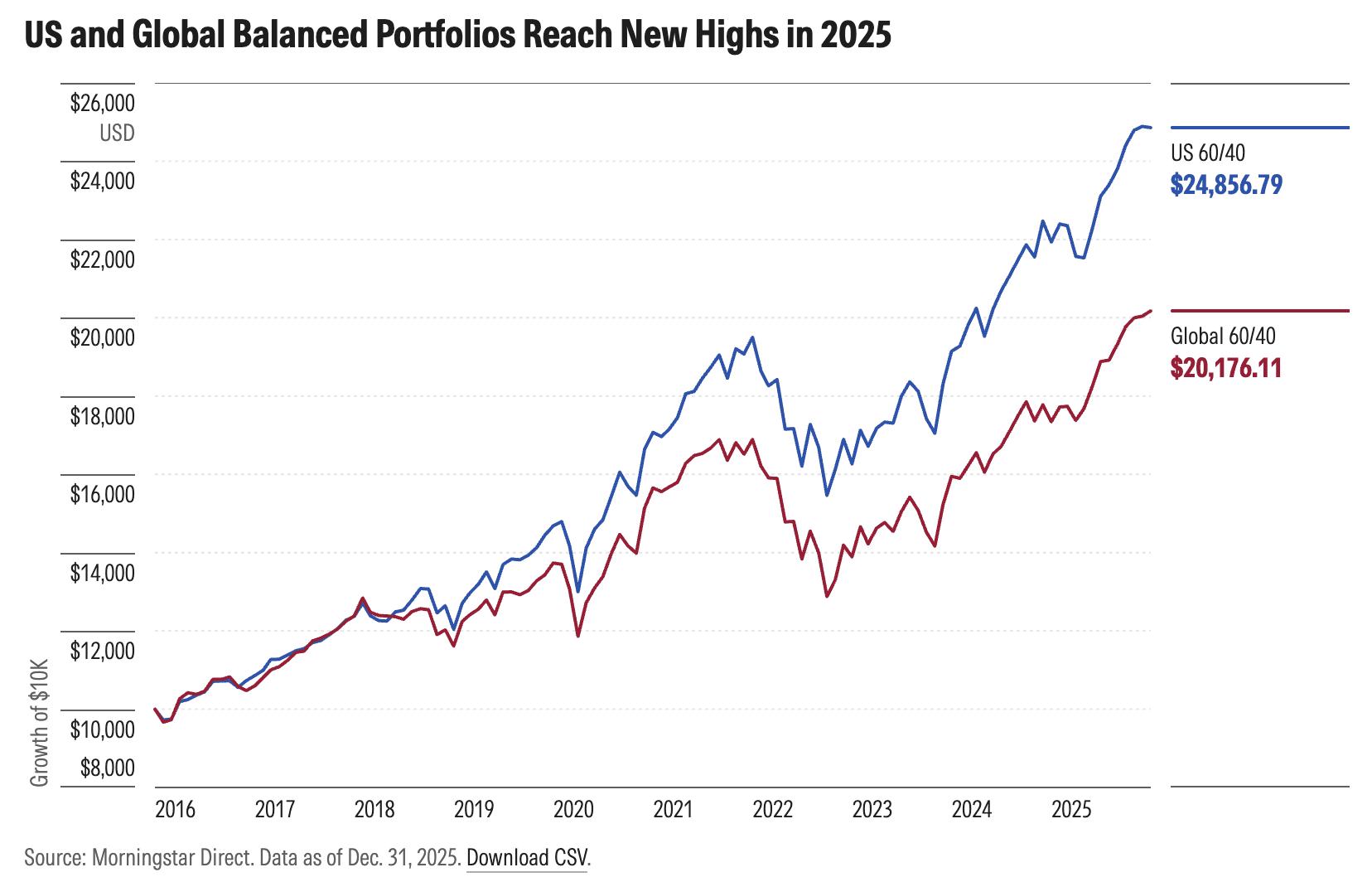

Balanced Portfolios: Still Relevant

The traditional 60% stocks/40% bonds portfolio took criticism after 2022's simultaneous decline in both asset classes. But reports of its death were premature. The global 60/40 portfolio gained 16% in 2025, reaching new all-time highs.

What's changed is the forward opportunity set:

Bond yields in the 4-5% range provide genuine income

Stocks continue offering the only reliable way to outpace inflation long-term

Negative correlation between stocks and bonds is reasserting itself

Starting valuations suggest 40/60 portfolios may offer better risk-adjusted returns over the next decade

The case for balanced portfolios rests on bonds now offering yield cushions unavailable at 1.5%, combined with stocks' continued long-term growth potential.

The Automated Investing Advantage

Building wealth doesn't require constant portfolio tinkering. Modern robo-advisors like Wealthfront, Betterment, and Fidelity Go provide:

Globally diversified portfolios using low-cost index funds

Automatic rebalancing to maintain target allocations

Tax-loss harvesting strategies adding meaningful after-tax returns

Management fees typically under 0.25%

Integration of high-yield cash management with investment portfolios removes friction that often prevents optimal capital deployment.

The Strategic Imperative

The current environment rewards intentionality:

Cash in checking accounts earning nothing represents clear opportunity cost

Allocations designed for zero-rate world may leave portfolios vulnerable

Short-term Treasuries yielding 4% offer risk-free alternatives

Balanced portfolios can generate meaningful income while preserving equity exposure

The investors who thrive won't necessarily be those who correctly predicted every rate move. They'll be those who recognized that higher rates created opportunities, built portfolios to capture those opportunities systematically, and maintained discipline through inevitable volatility.

Whether through automated platforms that handle the complexity, or direct investments in treasuries and high-yield savings, the tools exist to construct sensible strategies regardless of what happens next with Fed policy.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.