Education

When BlackRock's Bitcoin ETF surpassed $50 billion in assets within its first year—the most successful crypto ETF launch in history—it marked a definitive shift in how institutions view digital assets. The question is no longer whether Bitcoin belongs in portfolios, but how much exposure makes sense and what investors should expect from the allocation.

The Correlation Story Has Changed

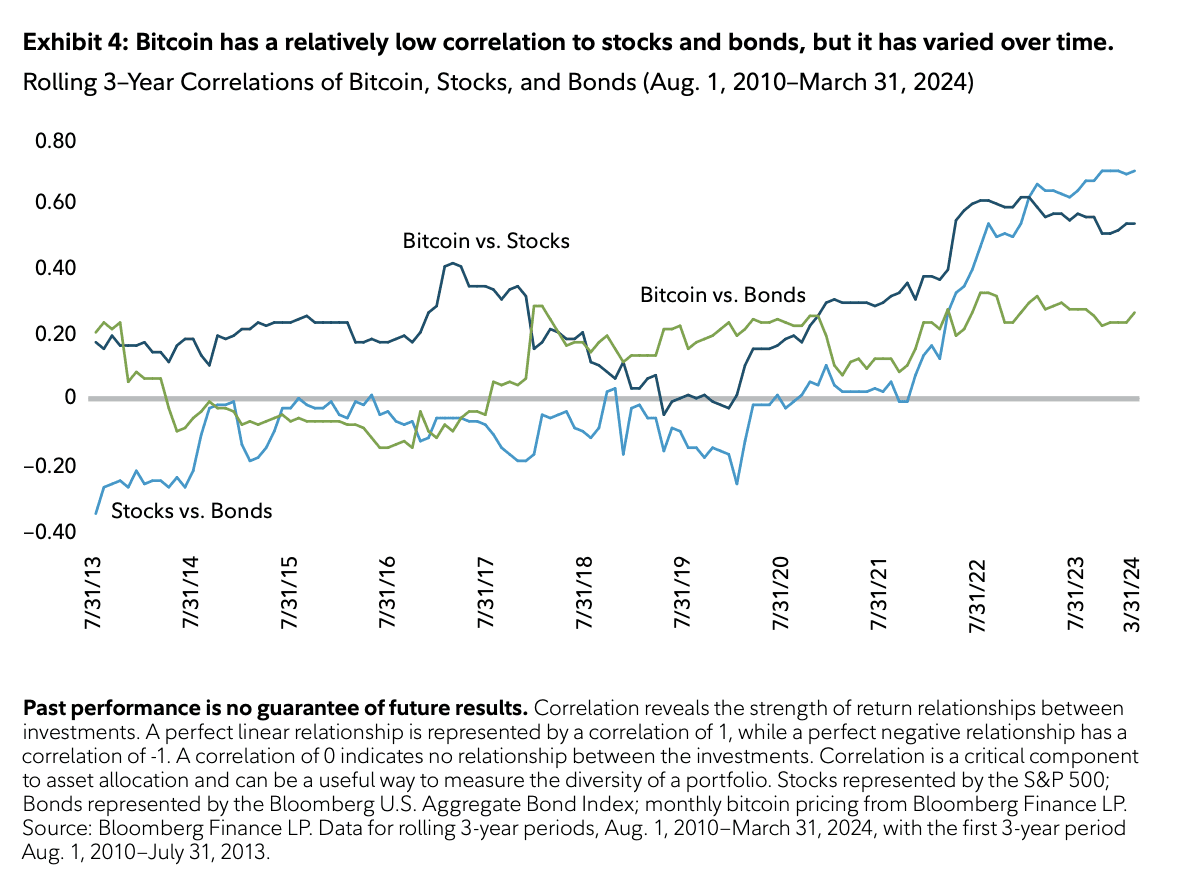

The traditional narrative positioned Bitcoin as entirely uncorrelated to stocks and bonds, making it an ideal diversifier. The reality proves more nuanced. Research from Fidelity tracking data from August 2010 through March 2024 reveals Bitcoin's correlation patterns:

Bitcoin's 3-year rolling correlations:

Stocks (S&P 500): 0.53

Bonds (Bloomberg Aggregate): 0.26

Historical range: -0.1 to 0.6 across different market regimes

These figures sit well below the 0.7+ correlations typical among traditional assets, suggesting Bitcoin does provide diversification benefits—though not perfectly. The correlation shifts based on market conditions. During the 2022 correction, Bitcoin's correlation with the S&P 500 averaged around 0.1 but spiked above 0.4 during periods of extreme stress.

More importantly, recent analysis shows Bitcoin's S&P 500 correlation surged to 0.87 in 2024, reflecting its integration into risk-on portfolios as institutional capital flooded in through ETF vehicles. This creates a paradox: increased institutional adoption improves liquidity and reduces volatility, but also tightens Bitcoin's relationship with traditional risk assets.

The Institutional Stampede

The ETF approval transformed Bitcoin from speculative frontier to legitimate treasury asset. The numbers tell the story:

2024-2025 Institutional Adoption Metrics:

Professional investors hold 26.3% of Bitcoin ETF AUM as of Q4 2024, up from 21.1% in Q3

Hedge funds account for 41% of all institutional Bitcoin ETF holdings

335 entities collectively hold 3.75 million BTC worth hundreds of billions

Universities, pension funds, and sovereign wealth funds have begun allocating. Harvard, Brown, Emory, Wisconsin, and Michigan retirement systems all reported Bitcoin ETF positions in 2024-2025 regulatory filings, representing cautious but meaningful exposure from fiduciaries traditionally focused on capital preservation.

Corporate treasuries present an even more dramatic adoption curve. MicroStrategy alone holds over 628,000 BTC valued above $70 billion, while companies across industries have added Bitcoin reserves as inflation hedges and strategic assets.

Volatility: Feature or Bug?

Bitcoin's volatility remains extreme by traditional standards, though declining materially from 200% in 2012 to approximately 50% in 2025. For context, that's still roughly 3.6 times gold's volatility and 5.1 times that of global equities.

The volatility creates both opportunity and risk:

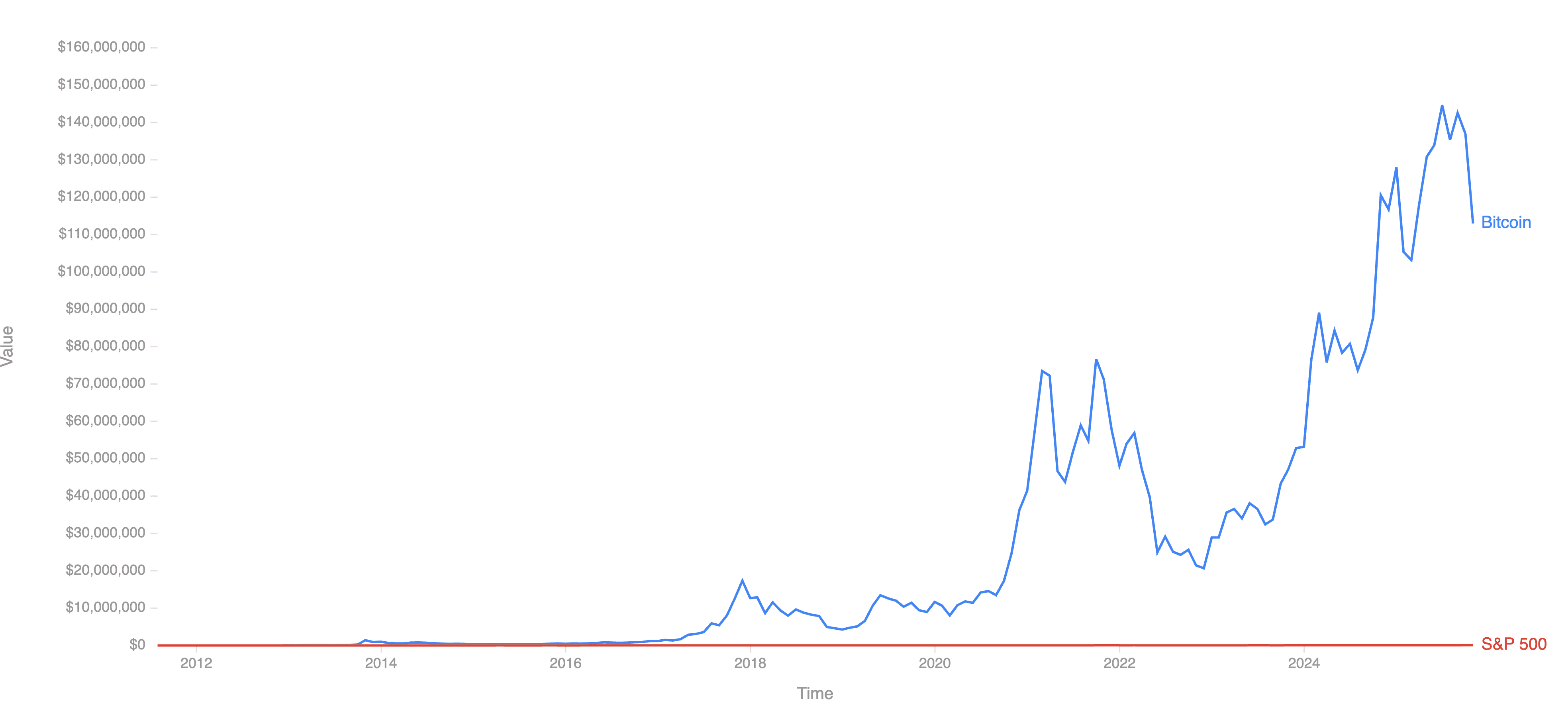

The upside: From 2014 to 2024, Bitcoin delivered a 54% annualized return, ranking as the top-performing asset in eight of those eleven years. When Bitcoin wins, it wins big—often delivering triple-digit annual gains.

The downside: In the three years Bitcoin underperformed, it ranked dead last among major asset classes, suffering drawdowns of 50-80%. The October 2025 correction saw Bitcoin plunge from $126,000 to $81,000—a 35.9% drop—before stabilizing.

This binary performance profile explains why proper position sizing matters more for Bitcoin than any traditional allocation.

The Allocation Framework

Professional guidance has coalesced around modest exposure levels. The reasoning: Bitcoin's low correlation means even small allocations can enhance returns without proportionally increasing portfolio volatility.

Research-backed allocation ranges:

1% Bitcoin allocation: Historically improved annual returns by 1.5% with minimal volatility impact

1-5% allocation: Standard recommendation from most advisors, balancing upside potential against downside risk

5% allocation: Contributes roughly 15% of total portfolio risk

10% allocation: Contributes 28% of total portfolio risk

BlackRock's analysis positions Bitcoin alongside gold as a diversifying alternative with low correlation to equities—though their 10-year correlation of 0.15 between Bitcoin and the S&P 500 suggests even this baseline fluctuates.

The allocation approach matters as much as the percentage. Dollar-cost averaging has emerged as institutional standard practice, with businesses allocating a median 10% of monthly net income to Bitcoin through systematic purchase programs in 2025.

What Bitcoin Actually Does

The academic evidence on Bitcoin's portfolio impact reveals complexity. Analysis from 21Shares tracking data from April 2022 through March 2025 found:

Bitcoin's average correlation with the asset universe: 36%

This sits meaningfully lower than correlations among traditional assets, which often cluster above 60-70%. The key insight: Bitcoin behaves differently enough from stocks, bonds, and real estate to introduce genuinely independent return streams.

However, correlation patterns shift dramatically during crises. The March 2020 market crash saw nearly all assets, including Bitcoin, fall in tandem—eliminating diversification benefits precisely when investors needed them most. This "correlation breakdown" during extreme stress events limits Bitcoin's role as true portfolio insurance.

The Practical Reality

Building Bitcoin into portfolios requires acknowledging both structural changes and persistent uncertainties:

What's improved:

Regulatory clarity through ETF approvals and expanding frameworks

Institutional-grade custody solutions eliminating technical barriers

Bitcoin's Sharpe ratio reached 2.42 by 2025, placing it among top global assets by risk-adjusted returns

Declining volatility as markets mature and liquidity deepens

What remains challenging:

Extreme price swings that can test investor discipline

Rising correlation with equities as institutional adoption accelerates

Regulatory risks despite improved framework

Unclear behavior during extended recessionary environments

The evolution toward portfolio staple status continues. CF Benchmarks' institutional analysis argues Bitcoin can now be evaluated using the same capital market assumptions applied to traditional assets—expected returns, volatility, correlations—rather than as a speculative outlier.

The Strategic Case

Bitcoin's portfolio role isn't about replacing stocks or bonds. It's about introducing an asset with fundamentally different drivers: fixed supply dynamics, global accessibility, censorship resistance, and adoption by both institutions and nation-states.

The mechanism matters more than the magnitude. A 2-3% Bitcoin allocation won't transform portfolio returns overnight, but it provides exposure to a genuinely distinct return stream driven by technology adoption curves rather than economic cycles. When combined with disciplined rebalancing—selling into strength, buying during panic—the allocation can enhance long-term risk-adjusted returns without creating concentration risk.

For investors using data-driven platforms that automate rebalancing based on volatility signals and correlation shifts, Bitcoin becomes a portfolio component that can be systematically managed rather than emotionally traded. That's the framework institutional investors have adopted, and it explains why Bitcoin's role continues expanding even as short-term volatility persists.

The question isn't whether Bitcoin deserves portfolio space. It's whether your strategy can capture the benefits while managing the risks.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.