Education

The turn of the calendar offers more than just a fresh start—it's a natural checkpoint to assess whether your portfolio still reflects your goals and risk tolerance. Yet for many investors, rebalancing remains an afterthought, addressed sporadically or ignored entirely until market turmoil forces reactive decisions.

The investment landscape is shifting. AI adoption in portfolio management surged in 2024, with 91% of asset managers either currently using or planning to use AI in asset-class research and portfolio construction. As we enter 2026 with monetary policy uncertainty and market volatility, the case for systematic, algorithm-driven rebalancing has never been stronger.

The Hidden Cost of Portfolio Drift

When you construct a 60/40 stock-bond portfolio, that ratio represents a deliberate balance between growth and protection calibrated to your circumstances. But market movements quickly disrupt this equilibrium. A strong equity rally can push that 60/40 to 72/28 before you notice, fundamentally altering your risk exposure.

The performance implications are significant:

DALBAR studies show the average investor underperforms market indices by 2-3% annually, primarily due to emotional decision-making

Portfolios drifting 5%+ from target allocations can underperform by 0.5-1% annually

During March 2020, allocation deviations reached 7-10% for portfolios using traditional rebalancing methods

Rebalancing systematically enforces buy-low, sell-high discipline that behavioral finance research shows most investors struggle to execute independently.

Threshold-Based Rebalancing: Smarter Than Calendar Intervals

Traditional advisory practice favors quarterly or annual rebalancing—neat calendar intervals that fit service schedules. But markets operate on their own timeline. A portfolio might experience negligible drift over nine months, then surge dramatically off-target during a single turbulent week.

Research analyzing 29 years of rebalancing strategies found that threshold-based approaches—rebalancing only when allocations breach predetermined percentage bands—delivered more consistent risk management than rigid calendar intervals.

Key findings from Vanguard's December 2024 research:

Threshold-based rebalancing using 200 basis point bands generated lower transaction costs than monthly methods

10,000 simulations over 10-year periods confirmed superior risk-adjusted outcomes

Continuous monitoring captures opportunities missed by quarterly reviews

The challenge? Threshold monitoring requires constant surveillance—exactly where algorithmic systems excel.

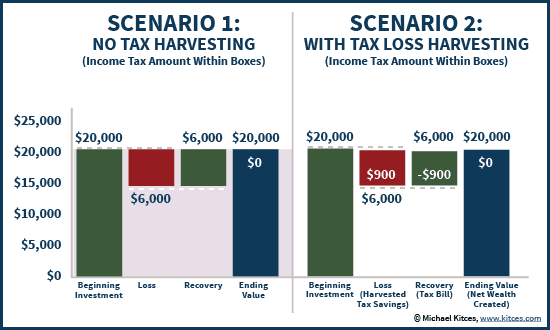

Tax-Loss Harvesting: The Compounding Advantage

For taxable accounts, automated tax-loss harvesting represents perhaps the most compelling argument for AI-powered portfolio management. The mechanics are straightforward: sell securities trading below their purchase price to realize losses that offset taxable gains, then immediately reinvest in similar assets to maintain market exposure.

The execution demands sophistication:

Wealthfront helped clients save an estimated $1 billion in taxes over the past decade

$145 million in losses harvested in 2024 alone across their platform

Range Advisory members averaged $16,000 in harvested losses, translating to ~$6,000 in tax offsets

Research shows that systematic loss harvesting can add 0.5-1.5 percentage points of annual after-tax alpha—meaningful value that compounds significantly over time.

Analysis of Bloomberg yield data from 2001-2024 found that municipal bond and investment-grade corporate bond yields rarely peaked in December—only 8% and 4% of the time, respectively—suggesting year-end tax reviews miss the majority of optimal harvesting windows.

Market Context: Why 2026 Demands Discipline

The Federal Reserve cut interest rates three times in 2025, bringing the federal funds rate to 3.50-3.75%, with officials signaling a cautious path ahead. The December 2025 Summary of Economic Projections indicated consensus for just one additional cut in 2026.

Current market environment:

Bond futures markets assign only 16% probability to a January 2026 cut, rising to 45% by April

Congressional Budget Office projects rates settling at 3.4% by late 2028

Equity valuations remain elevated relative to historical averages

This environment argues for disciplined rebalancing rather than market timing. When equities have delivered strong returns, portfolios naturally become overweight in assets that may be priced for perfection. Systematic rebalancing enforces profit-taking discipline.

The Behavioral Advantage: Removing Emotion From Execution

Perhaps the most underappreciated benefit of automated rebalancing is psychological. Consider a common scenario: a sharp market correction pushes your equity allocation below target. Disciplined rebalancing would dictate buying stocks when they're down—precisely when headlines are most alarming.

Automated systems don't experience fear or greed. They execute predefined rules regardless of market sentiment or media narratives. This emotional distance proves invaluable during market stress, ensuring investment policy—carefully constructed during calm periods—remains in force when it matters most.

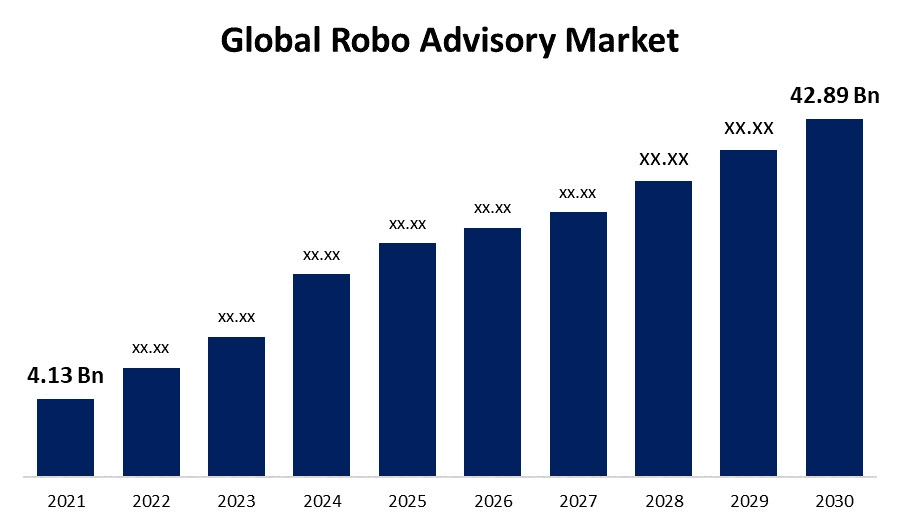

The Growth of AI-Powered Portfolio Management

The numbers tell a compelling story:

Global robo-advisor AUM reached $2.06 trillion in 2025, projected to hit $2.38 trillion by 2029

Vanguard Digital Advisor manages over $311 billion, demonstrating institutional adoption

68% of hedge funds now employ AI for market analysis and trading strategies

Deloitte found 65% of asset managers integrated AI by 2024, up from 45% in 2021

This isn't just institutional adoption—the global robo-advisory market is projected to grow from $10.86 billion in 2025 to $69.32 billion by 2032, reflecting widespread recognition of AI's role in modern portfolio management.

Implementation: Getting Started With Surmount

For investors contemplating AI-powered portfolio management entering 2026, Surmount offers a platform specifically designed to deliver institutional-quality rebalancing and optimization capabilities directly to individual investors.

What makes Surmount different:

No-code strategy creation: Build sophisticated portfolio strategies without programming expertise

Continuous threshold monitoring: Automatic rebalancing when allocations drift beyond your specified parameters

Tax-aware optimization: Intelligent loss harvesting throughout the year, not just at year-end

Complete transparency: Understand exactly how and why every trade executes

Flexible customization: Set your own rebalancing thresholds, tax parameters, and investment constraints

Rather than choosing between expensive human advisors or basic robo-platforms, Surmount provides the sophisticated infrastructure institutional investors use—algorithmic precision combined with the control and transparency individual investors demand.

Take Action in 2026

As we move through 2026 against a backdrop of monetary policy transitions and elevated market valuations, the case for disciplined, systematic portfolio management strengthens. The explosive growth to over $1.2 trillion in global robo-advisor assets makes clear that algorithmic portfolio management has moved from experimental to essential.

The question isn't whether technology belongs in portfolio management—that question has been answered decisively. It's whether you'll leverage these capabilities to implement your investment policy with greater precision and consistency than manual methods allow.

Ready to optimize your portfolio for 2026? Explore Surmount and discover how AI-powered rebalancing can help you maintain your target allocation, harvest tax losses systematically, and remove emotional decision-making from your investment process.

Automate any portfolio using data-driven strategies made by top creators & professional investors. Turn any investment idea into an automated, testable, and sharable strategy.